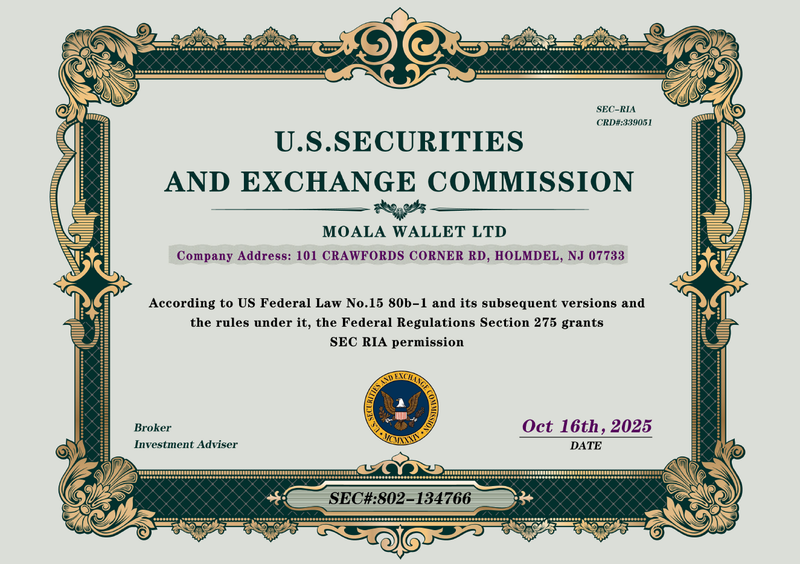

MOALA WALLET Exchange has unveiled an enhanced global brand strategy centered on regulatory compliance, operational transparency, and institutional-grade infrastructure. Supported by its existing U.S. regulatory registrations with the Financial Crimes Enforcement Network (FinCEN) and the U.S. Securities and Exchange Commission (SEC), alongside a pending advanced license application in Poland, the platform is reinforcing its position as a compliance-oriented digital asset exchange serving both retail and institutional users.

As regulatory oversight across global digital asset markets continues to intensify, MOALA WALLET Exchange stated that the updated brand positioning reflects a structural commitment rather than a cosmetic refresh. The strategy is designed to align the platform’s technology development, governance standards, and operational practices with evolving regulatory expectations in major financial jurisdictions.

Building a Multi-Jurisdictional Compliance Framework

A central element of MOALA WALLET Exchange’s positioning is its multi-license compliance framework. The platform operates under a U.S. Money Services Business (MSB) registration issued by FinCEN and maintains regulatory filings with the SEC, enabling it to function within one of the world’s most closely regulated financial environments.

In Europe, MOALA WALLET Exchange has completed key regulatory preparation milestones and advanced its compliance alignment for market entry within the European Union. The platform’s European framework is designed to support localized operations, regulatory coordination, and long-term compliance across multiple EU jurisdictions, reflecting its broader strategy to establish a sustainable and transparent presence in the region.

Compliance as a Core Brand Principle

“Trust has become the defining currency of financial technology,” said Aaron Blythe, Director of External Relations at MOALA WALLET Exchange. “Our objective is not only to deliver advanced digital trading capabilities, but to operate clearly and responsibly within established legal frameworks. This approach provides confidence to users, partners, and regulators alike.”

Blythe added that regulatory alignment is no longer a secondary consideration for digital asset platforms. “We have seen how quickly reputational risk can undermine an entire ecosystem. By embedding compliance and operational integrity into the foundation of our platform, our brand naturally aligns with the standards expected by global financial authorities.”

Institutional-Grade Operations Supporting Long-Term Stability

MOALA WALLET Exchange’s institutional-grade operating model includes segregated client asset handling, automated anti-money laundering and know-your-customer (AML/KYC) systems, comprehensive audit trails, and AI-driven risk monitoring designed to detect anomalies and operational irregularities.

Combined with its expanding global infrastructure and localized compliance expertise, these capabilities enable MOALA WALLET Exchange to deliver consistent, regulation-aligned services across both established and emerging markets.

About MOALA WALLET Exchange

MOALA WALLET Exchange is a global digital asset exchange focused on compliance-driven operations, secure infrastructure, and sustainable platform development. The company holds U.S. regulatory registrations and continues to expand its regulatory presence across Europe and Asia, providing regulated, high-performance digital asset services for retail and institutional participants.

Disclaimer:

The information provided in this press release is not a solicitation for investment, nor is it intended as investment advice, financial advice, or trading advice. Investing involves risk, including the potential loss of capital. It is strongly recommended you practice due diligence, including consultation with a professional financial advisor, before investing in or trading cryptocurrency and securities. Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release.

This press release was originally published on this site