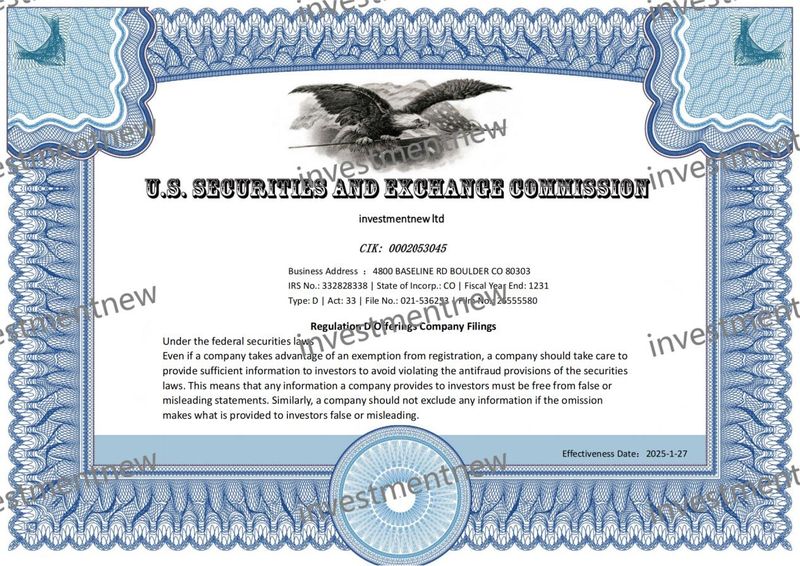

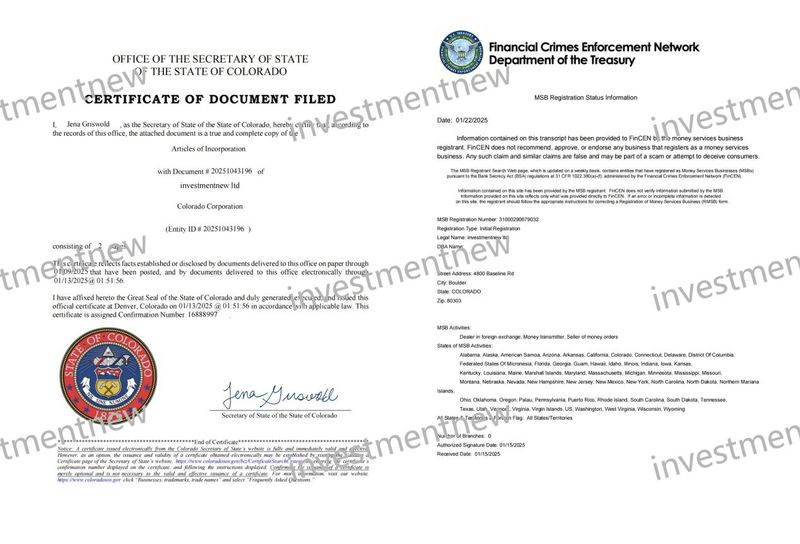

InvestmentNew, a leading financial and cloud computing investment platform, has officially announced that it has successfully obtained licenses for Money Services Business (MSB) from the U.S. Financial Crimes Enforcement Network (FinCEN) and the Securities and Exchange Commission (SEC). This milestone achievement signifies a new level of compliance in global operations for InvestmentNew and further solidifies its leadership position in the fintech and cloud computing investment market. Additionally, InvestmentNew will establish strategic partnerships with international financial institutions to jointly promote global market development, providing users with a safer, more transparent, and efficient investment environment.

Entering the Global Compliance Financial System with SEC and MSB Licenses

The SEC license allows InvestmentNew to offer legal securities and investment trading services in the U.S., while the MSB license further authorizes the company to conduct international remittances, cryptocurrency trading, foreign exchange transactions, and payment settlement services. These two crucial certifications position InvestmentNew as a regulated global fintech platform, providing solid legal backing for its cloud computing investments, short-term trading, ETF trading, options trading, and diversified wealth management products.

CEO Anar Gajiev stated at the press conference, “Obtaining the SEC and MSB licenses not only demonstrates InvestmentNew’s excellence in compliance management but also enhances our competitiveness in the international financial market. Global users can confidently use our investment services, knowing their funds and data are protected by the highest levels of financial regulation.”

In the future, InvestmentNew plans to apply for licenses from the UK’s Financial Conduct Authority (FCA), Singapore’s Monetary Authority (MAS), and Hong Kong’s Securities and Futures Commission (SFC) to further expand into European and Asian markets, ensuring global business compliance.

Enhancing Global Market Competitiveness through Partnerships with International Financial Institutions

InvestmentNew has announced strategic collaborations with several leading global financial institutions, covering market data services, payment solutions, foreign exchange trading, and commodity markets.

Core Aspects of the Collaboration Include:

– Provide real-time data for the global foreign exchange market, helping users analyze market trends accurately and improve trading success rates. Enhancing investment support for commodities, precious metals, and energy markets through the global futures trading platform provided by CME Group.

– Diversified Financial Product Optimization: Offer lower-cost foreign exchange trading services, further optimizing the short-term trading experience. Partnering with international fund companies to launch a variety of ETF products to meet different risk preferences of investors.

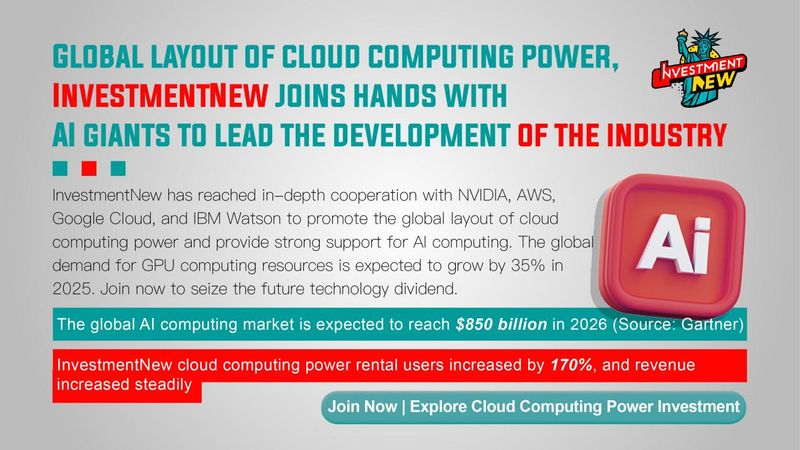

– Cloud Computing Technology Upgrade: Enhancing return rates on cloud computing investments. Utilizing an AI computing scheduling system to optimize big data analysis, increasing the stability and transparency of cloud computing returns.

– Payment System Upgrade to Optimize Fund Liquidity: Ensure global users can securely and quickly recharge accounts, conduct transactions, and withdraw funds. Implementing bank account synchronization features provided by Plaid, enabling users to easily manage investment accounts and ensuring transaction convenience and security.

Building a New Ecosystem for Global Fintech and Cloud Computing Investment

Andrew Collins, Executive Vice President of the company, stated, “Marks InvestmentNew’s official entry into the ranks of top global financial service platforms. We will leverage resources from world-class financial institutions provide the highest quality investment experience for our global users.”

Against the backdrop of global market expansion, InvestmentNew plans to enter over 20 new country markets in the next two years and strengthen cooperation with government regulatory agencies to further promote global compliance development.

Future Outlook: Continuous Innovation to Lead a New Era of Fintech

With the deep integration of cloud computing, big data, artificial intelligence, and financial markets, InvestmentNew will continually drive innovative development in fintech, creating a safe, efficient, and low-cost global investment platform for users. In the future, the company will:

– Continuously optimize the AI trading system to improve investor returns.

– Further expand into the cryptocurrency and cloud computing investment markets to enhance the stability of user returns.

– Apply for more international financial licenses to ensure global business compliance.

CEO Anar Gajiev concluded, “Our vision is to become the most trusted fintech platform for global investors. With the recognition of the SEC and MSB licenses and deep cooperation with top global financial institutions, we are moving toward a broader future.”

About InvestmentNew

InvestmentNew is a globally leading fintech and cloud computing investment platform headquartered in the U.S. The company offers cloud computing investments, stock trading, ETFs, options trading, cryptocurrency trading, and other diversified investment services, having obtained SEC and MSB regulatory licenses. Leveraging deep collaborations with international financial institutions, InvestmentNew continuously optimizes its investment ecosystem to provide global investors with secure, transparent, and efficient wealth management solutions.

Media Contact

Contact: Michael G. Wiltse

Company Name: InvestmentNew Ltd

Website: https://investmentnewltd.com

Contact: Michael@investmentnewltd.com

Disclaimer: The information provided in this press release is not a solicitation for investment, nor is it intended as investment advice, financial advice, or trading advice. It is strongly recommended you practice due diligence, including consultation with a professional financial advisor, before investing in or trading cryptocurrency and securities.

This press release was originally published on this site