Gold (XAU/USD) trades with a negative bias for the second consecutive day on Friday, though it manages to hold above the overnight swing low through the Asian session. The US Dollar (USD) retreats slightly after hitting its highest level since early August, providing a tailwind for the precious metal.

Meanwhile, bets for US Federal Reserve (Fed) rate cuts, the ongoing US government shutdown, and rising geopolitical risks continue to support the yellow metal. The brokers at Logirium provide a full and accessible analysis of this issue.

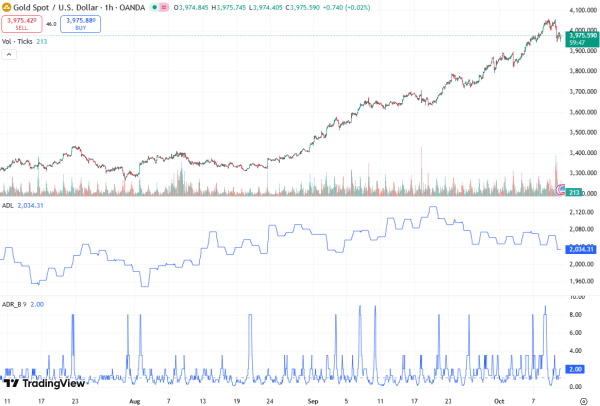

Gold’s Current Technical Stance

Despite showing a negative bias, Gold lacks significant follow-through selling, indicating cautious positioning among traders. The 100-hour Simple Moving Average (SMA) remains a key technical level, and the overnight swing low near $3,944 represents critical support.

Failure to hold this level could signal the start of a corrective decline towards the $3,900 round figure, a psychological barrier closely watched by market participants.

The precious metal’s inability to sustain significant losses amid a retreating USD highlights the resilient demand for safe-haven assets, particularly as market uncertainty persists. With short-term charts remaining overbought, traders should exercise caution before expecting a strong extension of the recent rally.

USD Retreat Provides Tailwind

The US Dollar retreated slightly on Friday after registering strong weekly gains to a two-month peak. This modest downtick in USD has a direct impact on Gold, which is inversely correlated with the greenback.

The USD’s previous strength prompted profit-taking among Gold bulls, yet the metal continues to find support near the $3,944 swing low. Market participants now monitor the USD’s moves closely, as any further weakness could provide additional momentum for XAU/USD to retest key resistance levels around $4,035–$4,036.

Fed Rate Cut Expectations

Fed rate cut bets remain a major driver for Gold. Traders continue to anticipate at least two interest rate reductions by the end of the year, despite lingering inflation concerns revealed in the September FOMC Minutes.

Fed Chair Jerome Powell has offered no fresh policy signals, leaving markets reliant on indirect cues. The possibility of easier monetary policy fuels demand for Gold, as lower interest rates reduce the opportunity cost of holding non-yielding assets, reinforcing its safe-haven appeal.

Geopolitical Risks and Safe-Haven Demand

Geopolitical tensions continue to bolster Gold’s fundamentals. The US President emphasized pressure on Russia alongside NATO allies to resolve the war in Ukraine. Meanwhile, Ukraine reported a large-scale Russian assault on Kyiv, including ballistic missiles and drone strikes targeting critical infrastructure, resulting in widespread power outages.

Although a ceasefire deal between Israel and Hamas provided temporary optimism, ongoing geopolitical uncertainty offsets the positive sentiment and supports safe-haven buying. Such conditions typically encourage risk-averse traders to accumulate Gold, maintaining the metal’s upward momentum despite short-term corrections.

Key Technical Levels for Gold

Support Levels: The immediate overnight swing low near $3,944 is critical. Below this, a corrective decline could accelerate toward $3,900, a psychological and technical barrier.

Resistance Levels: Any intraday rebound faces resistance around $4,035–$4,036, with further upside towards $4,059–$4,060, marking the all-time high touched recently. Beyond this, Gold could test the $4,100 round figure if bullish momentum resumes.

Monitoring these technical zones is essential for traders seeking short-term entry or exit points. A breakdown below support could indicate bearish exhaustion, while a decisive move above resistance might reignite a record-setting rally.

Market Outlook Ahead

Gold remains volatile yet resilient, balancing a negative intraday bias with fundamental support. Traders watch USD movements, Fed communications, and interest rate expectations for potential sharp moves. Geopolitical events like the Ukraine conflict and Middle East tensions, along with US fiscal updates such as shutdowns and funding bills, also influence Gold’s trajectory.

Despite the lack of follow-through buying, Gold continues to benefit from a combination of monetary easing expectations, geopolitical uncertainty, and safe-haven demand. The metal remains on track for its eighth consecutive weekly gains, signaling strong medium-term bullish sentiment amid technical and fundamental support.

Conclusion

Gold finds itself at a critical juncture, trading with a negative bias but supported by a retreating USD, Fed rate cut bets, and escalating geopolitical risks. While intraday declines could emerge if the $3,944 swing low breaks, the overall fundamental and technical backdrop remains favorable. Traders should monitor key support and resistance levels, Fed commentary, and market risk sentiment to navigate the potential swings in XAU/USD as the week closes.

Gold continues to demonstrate its role as a safe-haven hedge amid uncertainty, highlighting the delicate interplay between monetary policy, geopolitical developments, and technical momentum.