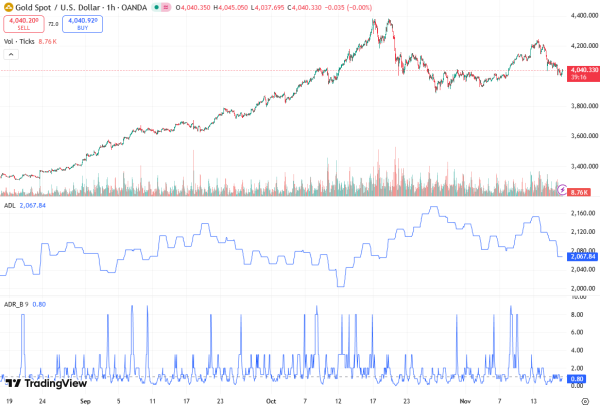

Gold Rebounds From Sub-$4,000 Levels

Gold (XAU/USD) staged a modest recovery on Tuesday, bouncing off a one-week low below the $4,000 psychological mark. The precious metal found support amid a weaker US Dollar (USD), driven by concerns over slowing US economic momentum and the impact of the longest-ever US government shutdown. LFtrade brokers outline the essential details of the topic with clarity and precision.

Despite expectations for a less dovish stance from the Federal Reserve (Fed), the USD struggled to capitalize on the previous session’s gains. This weaker risk sentiment and renewed safe-haven demand for Gold helped the XAU/USD pair stabilize after its recent decline from the mid-$4,200s, observed in the past week.

Investors appear cautious, preferring to await key economic data releases and the FOMC Minutes before committing to large positions. The non-yielding nature of Gold makes it sensitive to shifts in interest rate expectations, and any reduction in Fed rate cut bets could limit further upside.

Safe-Haven Demand Offsets Reduced Fed Rate Cut Expectations

Gold attracted dip-buyers amid persistent risk-off flows, even as traders pared expectations for a December Fed rate cut. Several FOMC members recently signaled caution on additional monetary easing.

Fed Vice Chair Philip Jefferson noted that upside risks to inflation have moderated, while current policy rates remain somewhat restrictive. Jefferson emphasized a gradual approach as the Fed moves towards the neutral policy rate.

According to the CME Group FedWatch Tool, the probability of a 25 basis-point rate cut in December has fallen below 50%, reflecting the market’s growing skepticism about further easing. This shift has pressured the USD at times but has also constrained Gold bulls, keeping the XAU/USD rebound relatively modest.

US Government Shutdown Clouds Economic Outlook

The prolonged US government shutdown led to delays in economic data releases, undermining confidence in immediate USD strength. Market participants have been left with an absence of fresh metrics to guide trading, fueling safe-haven flows into Gold.

The reopening of the US government shifts focus back to important upcoming releases, including the Nonfarm Payrolls (NFP) report, which could significantly influence both USD and XAU/USD trajectories. Additionally, the FOMC Minutes may provide valuable insights into the Fed’s rate-cut path and future monetary policy, making these events crucial for traders monitoring market direction.

In addition, geopolitical tensions, including recent Russian military activity in Ukraine and cross-border incidents, maintain a risk-off environment that tends to favor Gold.

Technical Outlook: Resistance and Support Levels

Despite the modest rebound, Gold remains below the $4,000 pivotal level, indicating that upside remains limited. The 200-hour Exponential Moving Average (EMA) has acted as a near-term barrier, as XAU/USD recently failed to reclaim it.

Bearish traders may find the path of least resistance toward the downside if the $4,000 support fails. Key technical levels to watch include intermediate support at $3,931, the next significant support around $3,900, near late-October swing lows, and extended downside risk at $3,886, which marks previous consolidation lows.

Conversely, any sustained recovery attempt would need to overcome immediate resistance in the $4,053–4,055 region. A break above this zone could trigger short-covering rallies, potentially lifting Gold toward the 200-hour EMA just below $4,100.

A meaningful move above this level would suggest that the recent decline from mid-$4,200s has stabilized and may pave the way for further upside, although this remains contingent on USD weakness and broader market sentiment.

Market Implications

Traders should approach Gold with caution amid a mixed USD environment, which reflects weaker economic momentum but reduced Fed easing expectations.

Attention should be given to key upcoming events such as the FOMC Minutes and the delayed NFP report, as they could significantly influence market sentiment. Additionally, persistent geopolitical risks continue to provide safe-haven support, reinforcing Gold’s role as a hedge during uncertain times.

For now, XAU/USD is likely to experience modest swings rather than a sustained breakout above $4,000. Investors may focus on dip-buying opportunities around strong technical support, while keeping an eye on any short-covering spikes that could briefly push the commodity higher.

Conclusion

Gold has shown resilience in the face of renewed USD weakness, rebounding from a one-week low and testing key technical levels near $4,000. The non-yielding nature of Gold, combined with cautious Fed expectations, continues to cap upside potential.

While safe-haven demand provides support, traders are advised to monitor key economic releases, including the FOMC Minutes and NFP report, as these will likely dictate the near-term XAU/USD trajectory. Technical resistance around $4,053–4,055 and the 200-hour EMA near $4,100 may limit further gains, leaving Gold in a consolidative phase until a clearer direction emerges.