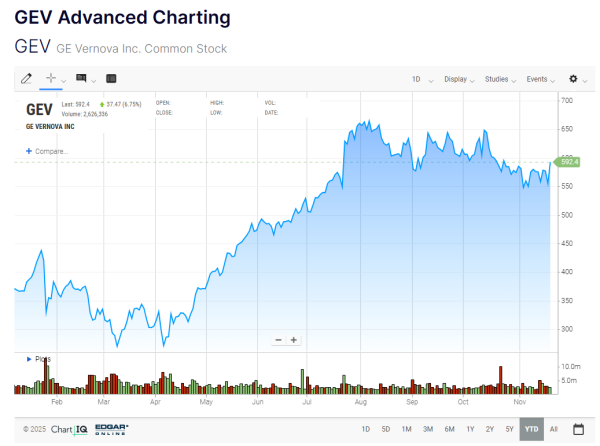

Brokers from LFtrade have been analyzing GE Vernova (GEV) following a notable 6.61% jump in shares as of early afternoon trading. The move comes after the company secured its first-ever wind repower upgrade contract outside the U.S., a deal that, while modest in size, is being viewed as a symbolic milestone for the company’s ongoing turnaround in its wind power business.

The Significance of the Taiwan Power Deal

The recent contract with Taiwan Power Company includes 25 repower upgrade kits for GE Vernova turbines and a five-year service agreement. While the order is relatively small, it provides confidence that management can capitalize on international growth opportunities, particularly in a sector where profitability has historically been challenging.

The deal highlights the company’s strategic focus on making its wind segment profitable, complementing its broader power and electrification operations.

A Remarkable Turnaround for GE Vernova

Long-time investors may recall the difficult years for General Electric, particularly in the gas turbine and renewable energy segments. Less than a decade ago, GE’s gas turbine business faced declining demand, and wind power, while growing, suffered from high costs, supply chain challenges, and logistical issues.

Today, the market narrative has shifted dramatically. The growing demand for power to support AI-driven data centers has created new opportunities, turning what was once a struggling segment into a key contributor to the company’s strategy.

GE Vernova’s power segment generated $1.9 billion in EBITDA during the first nine months of the year. Of this total, electrification contributed $929 million, while wind recorded a loss of $372 million. These figures highlight both the progress made and the challenges that remain, particularly as management works to turn the wind operations into a profitable business unit.

Opportunities and Challenges for Wind Power

The Taiwan deal is particularly important given the broader context of GE Vernova’s organic order trends. Total organic orders fell 10% in the first nine months compared to the previous year, with equipment orders down 21%.

This makes winning strategic contracts critical to offsetting slowing growth. With 57,000 wind turbines installed worldwide, GE Vernova has a substantial installed base to leverage for future repower contracts and service agreements.

Brokers note that the company’s ability to secure international contracts could signal a shift in market confidence. Expanding beyond the U.S. demonstrates that GE Vernova’s wind technology is competitive globally and that the company is gaining traction in international markets where renewable energy growth remains strong.

Power and Electrification Segments Benefit from AI Demand

While wind power is still in the process of turning profitable, GE Vernova’s power and electrification segments are significant beneficiaries of the growing global demand for electricity, particularly driven by AI-led data center expansion. The combination of reliable power solutions and electrification infrastructure positions the company well to capitalize on long-term structural demand in the energy sector.

Management’s Strategic Focus

Many financial experts emphasize that management has been taking targeted steps to improve profitability in wind power. The Taiwan contract is a tangible milestone, and continued focus on cost management, logistics optimization, and international expansion could help close the gap between the wind segment’s current losses and the overall company’s profit goals.

Additionally, the integration of services and repower upgrades allows GE Vernova to generate recurring revenue, a key metric that investors watch closely in capital-intensive industries like renewable energy.

Looking Ahead

The market will be watching closely for follow-up contracts, both domestic and international, to gauge whether GE Vernova can sustain momentum in its wind business. With total orders softening, each new contract carries additional symbolic and financial weight, reinforcing management’s narrative of a turnaround.

For investors, the combination of growth in electrification and power segments, along with strategic wind contracts, presents a diversified opportunity. While near-term profitability in wind remains a challenge, the company’s strategy, international expansion, and AI-driven demand tailwinds make GE Vernova a compelling story to monitor in the renewable energy sector.

Conclusion

In summary, GE Vernova’s shares surged on the first international wind repower contract, highlighting management’s progress in turning around its wind business. While challenges remain, including wind segment losses and declining equipment orders, the company’s power and electrification segments continue to generate strong EBITDA, supported by structural demand from AI data centers.

Investors should keep an eye on future international contracts and profitability milestones, as GE Vernova aims to transform its wind operations into a consistent profit center.