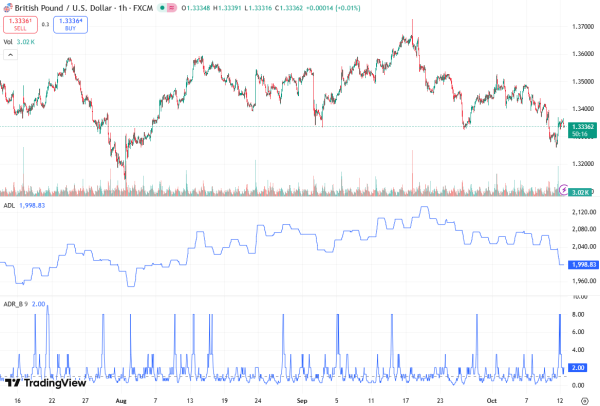

The GBP/USD pair has attracted buyers for the second straight day, maintaining a positive bias above the mid-1.3300s. Spot prices are trading in the Asian session just above this level, aiming to extend Friday’s rebound from the 1.3260 region, which marked the lowest point since August 5. In their latest piece, Arbitics experts present a thoughtful and accessible breakdown of the topic.

The recent upside momentum is underpinned by subdued US Dollar (USD) demand, as the safe-haven currency struggles amid risk-on sentiment. The combination of dovish Federal Reserve (Fed) expectations and a resilient British Pound (GBP) has been instrumental in sustaining intraday gains.

Divergent Fed-BoE Policy Expectations Support GBP

A key driver for the positive GBP/USD trajectory remains the policy divergence between the Fed and the Bank of England (BoE). Markets are pricing in two additional US interest rate cuts before the end of the year, reflecting expectations of a slower US growth and concerns over a potential government shutdown.

In contrast, the BoE is widely expected to keep rates on hold for the remainder of the year, lending a tailwind to the GBP. This divergence supports a stronger GBP/USD outlook, with buyers encouraged to maintain positions above mid-1.3300 levels.

Adding to the risk-positive environment, the US President’s backtracking on threatened 100% tariffs on Chinese imports has improved global risk sentiment, further reducing safe-haven USD demand and favoring GBP accumulation.

Technical Analysis: Fibonacci Levels and Key Resistance

From a technical perspective, the GBP/USD pair’s intraday strength is reinforced by Friday’s breakout above the 23.6% Fibonacci retracement of the monthly decline. This indicates a short-term bullish bias, though caution is warranted given mixed technical signals.

Traders should watch for follow-through above the 38.2% Fibonacci retracement level, which lies just above mid-1.3300s. A sustained break beyond this zone may open the door for a move towards the 1.3400 round figure, with potential upside targets at 1.3420-1.3425, coinciding with the 200-hour Simple Moving Average (SMA) and the 61.8% Fibonacci retracement level.

Conversely, oscillators on 4-hour and daily charts remain slightly negative, suggesting that fresh bullish bets should be approached with prudence. The GBP/USD could face intermittent resistance around the 1.3350-1.3360 region, requiring confirmation of momentum before committing to additional long positions.

Key Support Levels: Protecting the Downside

On the downside, the 1.3330-1.3325 zone now serves as immediate support, aligning with the 23.6% Fibonacci retracement. A breach of this level may expose 1.3300, followed by Friday’s low at 1.3260, which acts as a critical multi-month floor.

A decisive drop below 1.3260 could re-engage the longer-term bearish trend from the 1.3725 peak, recorded over two months ago. Further downside extension could push GBP/USD toward the 1.3200 round figure, with the 200-day SMA near 1.3180-1.3175 being a pivotal technical barrier.

Breaking below this key moving average would likely trigger renewed selling pressure, reinforcing the medium-term downtrend.

Impact of Geopolitical and Economic News

GBP/USD volatility remains sensitive to geopolitical developments and economic data releases. Any unexpected US economic slowdown, such as weaker nonfarm payrolls or retail sales, could weigh on the USD, providing further upside for the Pound.

Similarly, UK economic indicators, including GDP growth, inflation figures, and BoE commentary, could influence market sentiment and dictate the next directional move. Traders should monitor trade tensions, fiscal updates, and central bank signals, as these can trigger sharp intraday swings even within the mid-1.3300 range.

Short-Term Trading Opportunities

For intraday and short-term traders, GBP/USD offers several actionable setups near the mid-1.3300s. Bullish momentum above the 38.2% Fibonacci retracement may allow traders to target 1.3400 and the 1.3420-1.3425 confluence zone, while placing tight stop-loss orders below 1.3325 to manage risk.

On the downside, any rejection from resistance or a return below 1.3330 could open opportunities for short positions, with 1.3300 and 1.3260 serving as key support levels. Careful attention to momentum indicators and price action around Fibonacci zones is crucial to maximize gains while limiting exposure.

Conclusion: Positive Bias with Caution

In conclusion, the GBP/USD pair remains positively biased above mid-1.3300s, supported by divergent central bank expectations, dovish Fed bets, and improving risk sentiment. Technical indicators, particularly the Fibonacci retracement levels, offer clear reference points for both bullish and bearish traders.

While the trend favors GBP accumulation, mixed signals in oscillators and resistance around 1.3400 suggest that caution is warranted. Confirmation above 38.2% Fibo remains the key to fresh bullish momentum, whereas failure to hold mid-1.3300 support could re-engage the long-term downtrend, testing 1.3260 and lower levels.