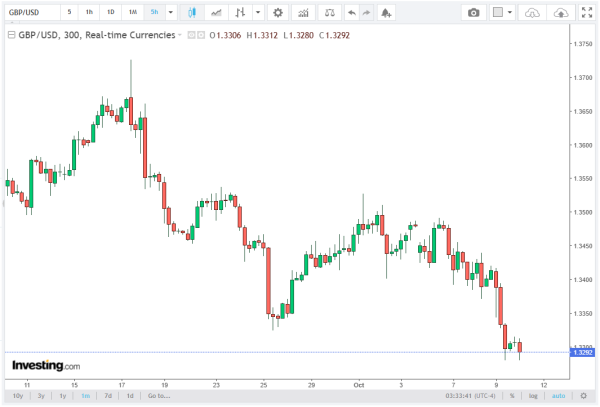

GBP/USD plunged sharply on Thursday, sliding nearly 0.8% and reaching the 1.3300 handle for the first time since early August. This move highlights mounting risk-off sentiment, which is propelling the safe-haven US Dollar higher amid a volatile macroeconomic backdrop.

Investors are showing growing concern over the ongoing US government shutdown, which is beginning to rattle markets and dampen risk appetite. Solancie professionals present a thorough overview of the topic with valuable insights.

The British Pound (GBP) has come under pressure as global investors shift toward safer assets, while the US Dollar (USD) continues to benefit from its status as the world’s primary reserve currency. Cable’s decline reflects both technical selling and fundamental concerns, creating a perfect storm for the pair’s bearish momentum.

US Government Shutdown Spurs Risk Aversion

The US federal government shutdown, now entering its ninth day, is increasingly weighing on market sentiment. Initially, investors appeared largely indifferent, but as the Senate gridlock persists, market apprehension is rising. Multiple budget bridging proposals from Democrats have been rejected by Senate Republicans, leaving key federal services inactive and official data releases suspended.

The lack of timely government datasets is forcing traders and analysts to rely more heavily on private economic indicators, creating uncertainty in pricing and volatility in the FX market.

This week, attention turns to the University of Michigan (UoM) Consumer Sentiment Index for October. Early projections indicate a slight drop in consumer confidence, as inflation pressures and trade war concerns continue to influence household sentiment.

GBP/USD Outlook

GBP/USD has extended its downtrend, breaking below recent consolidation near 1.3400. The pair is now testing the 200-day Exponential Moving Average (EMA) around 1.3280, which represents a critical support level. The daily close beneath the 50-day EMA at 1.3467 signals a shift in short-term momentum in favor of the bears.

The price action is dominated by long-bodied red candles, indicating strong selling pressure. The Relative Strength Index (RSI) currently reads 36, highlighting growing bearish momentum without entering oversold territory. This suggests that further downside is possible before buyers may step back in.

Should GBP/USD break below the 200-day EMA, the next technical target lies near summer lows around 1.3140, marking a potential retracement phase against the broader uptrend from early August. Traders are closely watching for defensive buying at these levels to assess whether the downtrend will continue or stabilize.

Market Drivers Behind GBP/USD Decline

The current GBP/USD weakness is largely driven by several key factors. Risk-off sentiment is boosting the US Dollar as a safe-haven, while ongoing political gridlock in Washington is prolonging the government shutdown, creating uncertainty.

Disrupted data flow has increased reliance on private economic reports, and technical momentum shows GBP/USD breaking key EMAs and forming bearish candlestick patterns.

Additionally, investor psychology is shifting toward lower-risk assets amid uncertainty. Collectively, these factors reinforce the Greenback’s appeal while putting pressure on Cable, highlighting the link between macroeconomic instability and FX market volatility.

Geopolitical and Economic Risks Add Pressure on GBP/USD

Beyond technical factors, geopolitical and economic risks are intensifying pressure on GBP/USD. The prolonged US government shutdown has heightened market uncertainty, reducing confidence in federal economic guidance.

Meanwhile, concerns over global trade tensions and inflationary pressures are weighing on both consumer sentiment and corporate investment, which could indirectly weaken the British Pound against the US Dollar. Additionally, the Bank of England’s recent statements on interest rate policy suggest caution, leaving GBP vulnerable amid a backdrop of dollar strength.

Upcoming Data and Event Risks

Traders will be closely monitoring the University of Michigan Consumer Sentiment Index release on Friday, with market expectations suggesting a slight decline. This potential drop is influenced by rising inflationary pressures eroding purchasing power, ongoing trade tensions affecting business and consumer confidence, and federal service disruptions caused by the government shutdown.

These factors could act as short-term catalysts for further GBP/USD moves, particularly if risk-off flows intensify and the US Dollar strengthens further.

Conclusion

GBP/USD‘s slide to 1.3300 underscores the combined impact of technical bearish momentum, risk-off sentiment, and political uncertainty in the US. The US Dollar continues to benefit from its safe-haven status, while Cable struggles to reclaim lost ground. Key technical levels, such as the 200-day EMA at 1.3280, will be crucial for traders to watch, as a break could open the path toward 1.3140.

For now, the market remains cautious, with traders balancing fundamental risks from Washington against technical signals pointing toward a deeper retracement. The combination of macroeconomic uncertainty and strong US Dollar demand suggests that GBP/USD may remain under pressure in the near term, with volatility likely to persist until the US government shutdown is resolved.