The EUR/USD currency pair enters the new week with renewed bullish interest as the Euro demonstrates signs of stabilizing and regaining momentum after facing a heavy selling wave in October. The brokers at Orbisolyx provide a comprehensive breakdown of this topic in this article.

Traders across trusted trading company platforms indicate that the pair is attempting a gradual recovery, supported by improving technical structure and rising confidence among Euro buyers. With the 1.1650 resistance level now in sight, investors are evaluating whether the current rebound has enough strength to evolve into a broader uptrend.

Technical Analysis of EUR/USD

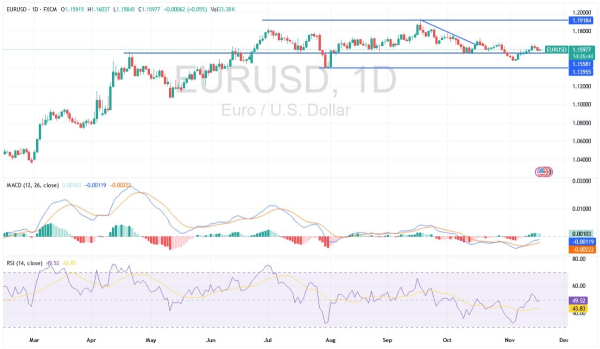

During the previous week, the EUR/USD pair successfully broke above the 21-day Exponential Moving Average (EMA), a level that had acted as a ceiling since early October. This breakout suggests an early shift in market sentiment, offering traders their first signal of potential trend reversal from bearish to bullish. Market technicians widely regard a break above the 21-day EMA as a structural improvement, especially when accompanied by growing upside momentum.

The pair is currently approaching a cluster of significant medium-term resistance levels, including the 50-day EMA and 100-day EMA, both of which are positioned near $1.1660. These indicators represent a critical zone that traders monitor when assessing whether a recovery is strong enough to transition into a fresh bullish phase. Historically, EUR/USD tends to pause or retrace near these levels before establishing a decisive move.

In the current technical setup, the descending trend line that guided the pair lower from September to late October has now been broken, providing an additional bullish signal. The combination of the trend-line breakout, a daily close above the 21-day EMA, and rising volume suggests improving resilience across the Euro.

However, for the recovery to be convincing, analysts highlight the necessity of overcoming resistance at 1.1620, where the 50-day EMA stands. A firm break above this region would validate the emerging bullish trajectory and open the door toward higher price targets.

Short-Term Targets and Bullish Scenarios

If the pair successfully clears the cluster of EMAs, the next targets will likely be the 1.1650 resistance level, followed by the 1.1700 psychological zone, both of which represent key areas where buyers may continue to push momentum higher.

A bullish push toward these levels would confirm that Euro momentum is strengthening and that buyers are gaining confidence. Yet the upward movement remains uncertain, especially in light of critical macroeconomic events scheduled for this week.

The pair’s behavior around the 1.1620–1.1660 zone will determine whether the current recovery is a temporary correction or the beginning of a stronger, sustained advance.

US Employment Data: A Decisive Catalyst

This week’s EUR/USD movements will be heavily influenced by the long-awaited return of official US economic statistics, particularly the US labor market data for September. The market consensus expects 50,000 new jobs (up from 22,000 in August) and an Unemployment rate of 4.3%

These figures play a crucial role in shaping expectations surrounding the Federal Reserve’s monetary policy, especially the trajectory of upcoming interest rate cuts. A better-than-expected reading could significantly weaken the Euro’s position.

The jobs report matters because it directly influences expectations for Federal Reserve policy and, in turn, shapes currency markets. A strong employment report would likely reduce the probability of a December Fed rate cut, since solid labor data signals economic strength and less need for easing.

This outcome would typically strengthen the US dollar, supported by higher yields and stronger sentiment. As a result, EUR/USD could move lower, potentially reversing recent gains as the firmer dollar weighs on the pair.

Weak Employment Data Could Support Euro Strength

On the other hand, recent private-sector economic surveys, released while official data were absent, point to a slowdown in the US labor market. If these signals are accurate, Thursday’s data may miss forecasts, thereby increasing the likelihood of a Fed rate cut in December.

Should the Federal Reserve proceed with a series of rate cuts extending into early 2026, the US Dollar could face broader structural weakness, opening the door for the Euro to revisit multi-year highs, including the 1.19 resistance level.

Outlook: Is the Euro Ready for Further Gains?

The Euro’s current bullish signal is promising, driven by improving technical indicators and shifting market sentiment, yet the path ahead remains heavily dependent on macroeconomic data.

If the technical breakout aligns with supportive US data, the Euro may extend its advance toward key resistance levels. But stronger-than-expected US economic performance could quickly halt the Euro’s momentum.