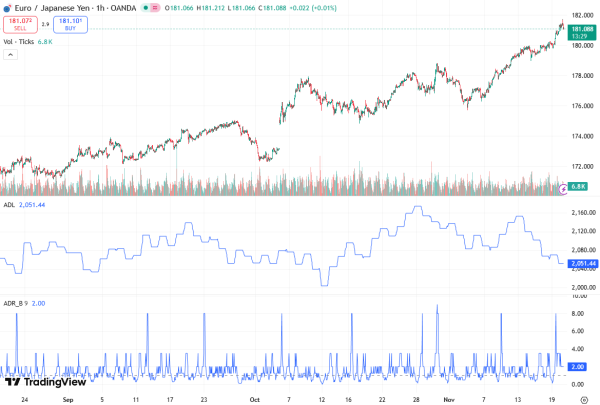

EUR/JPY extended its winning streak for the fourth successive session on Thursday, hitting a fresh all-time high of 181.73. During early European trading hours, the currency pair is currently trading around 181.40, reflecting persistent bullish momentum.

The pair continues to move within an ascending channel, signaling that the bullish bias remains intact despite some overbought conditions. Fimatron brokers outline the essential details of the topic with clarity and precision.

EUR/JPY Technical Analysis

The EUR/JPY cross demonstrates robust short-term momentum, as it trades comfortably above the nine-day Exponential Moving Average (EMA). The ascending channel pattern provides clear dynamic support and resistance levels, which are crucial for both intraday and swing traders.

The 14-day Relative Strength Index (RSI) has moved above the 70 level, indicating overbought conditions. Historically, such readings suggest a likelihood of a near-term downward correction, but the overall trend remains upward unless key support levels are breached.

Resistance Levels

On the upside, the initial resistance is located at the psychological level of 182.00. This level is significant because it aligns closely with the upper boundary of the ascending channel at 182.20, forming a confluence zone. Traders often monitor these areas for potential breakouts, which could reinforce the bullish trend.

Should the EUR/JPY manage to close above this confluence, the next target would be the crucial 183.00 level, representing a significant milestone for the pair. A sustained move above this threshold could attract additional buying interest, pushing the pair further into overbought territory.

Support Levels

The primary support lies at the lower boundary of the ascending channel, around 180.20, followed closely by the nine-day EMA at 179.85. These levels are critical in maintaining the uptrend. A break below this confluence zone could undermine the bullish momentum and expose the pair to a deeper correction toward the 50-day EMA at 176.65.

Monitoring these support and resistance levels allows traders to gauge potential entry and exit points, especially as the RSI signals a short-term pullback.

Macro Perspective: Japanese Yen Weakness

The Japanese Yen (JPY) has struggled against its peers recently, primarily due to the prospect of stimulus measures exceeding JPY 20 trillion, potentially to be unveiled by Prime Minister Sanae Takaichi. Such a fiscal expansion is generally negative for the JPY, providing further upside support for the EUR/JPY cross.

However, the upside potential could face headwinds if the Bank of Japan (BoJ) adopts a hawkish stance. A Reuters poll indicated that the BoJ may consider raising the policy interest rate from 0.50% to 0.75% at its December 18–19 meeting. This move could provide temporary support for the JPY, potentially restraining the EUR/JPY rally.

BoJ board member Junko Koeda emphasized that the central bank needs to continue raising policy interest rates and adjusting monetary accommodation in line with economic activity and price trends. Koeda’s comments suggest that the BoJ is willing to take steps to normalize policy, which may act as a counterbalance to fiscal stimulus in the near term.

Short-Term Outlook

In the short term, traders should monitor the RSI and EMA levels closely. The overbought reading indicates that a minor correction is likely, potentially bringing EUR/JPY down to the 180.20–179.85 support zone before the uptrend resumes.

If EUR/JPY holds above these support levels, the bullish bias is expected to persist, targeting the 182.00–183.00 range. Conversely, a break below the lower ascending channel boundary and the 50-day EMA could trigger a more substantial retracement, testing 176.65.

Key Technical Indicators

Key Technical Indicators show that RSI (14) is above 70, signaling overbought conditions. The nine-day EMA offers short-term support at 179.85, while the 50-day EMA acts as a major support at 176.65. Additionally, the ascending channel provides dynamic support and resistance, helping to guide price action.

Conclusion

The EUR/JPY cross continues to display a strong bullish momentum, having reached record highs of 181.73. The ascending channel pattern and proximity to the psychological 182.00 level suggest potential for further gains. Nevertheless, overbought RSI levels signal a near-term pullback, likely towards 180.20–179.85.

From a macro perspective, JPY weakness driven by potential fiscal stimulus supports the upside, while BoJ hawkishness may act as a short-term restraint. Traders should watch key support and resistance levels closely, as these will determine whether the EUR/JPY rally maintains its momentum or experiences a corrective phase.

In conclusion, while a short-term correction may be imminent, the technical and macro backdrop continues to favor EUR/JPY upside, with 182.00–183.00 as the immediate target zone.