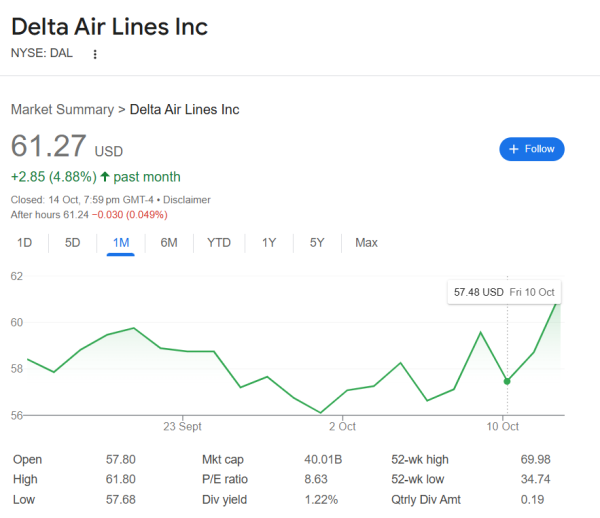

As the third-quarter earnings season kicks off, Delta Air Lines (NYSE: DAL) has taken center stage, and according to Tarillium analysts, the airline’s strong performance could serve as a bellwether for broader corporate resilience.

With consumer demand steadying, premium travel rebounding, and profits exceeding expectations, Delta’s report is sparking optimism across Wall Street. But beneath the surface, this surge may be more about Delta’s strategy than a reflection of overall economic health.

Delta’s Earnings Soar Above Expectations

For the quarter ended in September 2025, Delta delivered results that beat on nearly every front.

- Revenue grew 4.1% year over year, surpassing the high end of management’s guidance range.

- Operating margin came in at 11.2%, also above expectations.

- Non-GAAP earnings per share (EPS) reached $1.71, toward the top end of guidance.

This strong showing prompted Delta to raise full-year guidance, with EPS now expected to be around $6, up from prior estimates of $5.25 to $6.25. Free cash flow projections were lifted as well, to $3.5 billion–$4 billion.

CEO Ed Bastian and President Glen Hauenstein of Delta Air Lines credited this outperformance to strong premium demand and an improving main cabin environment. Over the past six weeks, sales trends have accelerated across all geographies and booking windows, suggesting robust demand heading into year-end.

Premium Travel Is Driving the Recovery

Delta’s momentum increasingly hinges on its premium travel segment, which continues to outperform the main cabin. In the third quarter, premium ticket revenue jumped 9% year over year to $5.8 billion, while main cabin sales slipped 4%. This underscores Delta’s strategic focus on higher-margin customers, a shift fueling its next growth phase.

President Glen Hauenstein noted that “the best margins are in the most premium products,” and CEO Ed Bastian highlighted a high single-digit rebound in business travel. With 25%–30% of new premium seats from retrofits and the rest from new aircraft, Delta is expanding profitably without oversaturating capacity..

Why Delta’s Success Doesn’t Mean the Economy Is Booming

While Delta’s strong quarter might tempt investors to extrapolate its results to the broader economy, that could be a misguided assumption.

First, much of Delta’s success reflects company-specific factors rather than macroeconomic trends. The carrier’s disciplined capacity management, including a slight reduction in main cabin seats, helped keep fares firm and load factors high. In contrast, low-cost competitors like Spirit Airlines, which recently filed for Chapter 11 bankruptcy, have struggled under pricing pressure and weakening budget demand.

Second, the competitive dynamics within the airline industry have changed. Airlines are no longer chasing market share at any cost. Instead, the industry has become more capacity-disciplined, focusing on profitability over volume. This structural shift benefits leaders like Delta, which can leverage brand strength, customer loyalty programs, and premium offerings to maintain pricing power even in a slower-demand environment.

Lastly, regional revenue trends reveal underlying softness. Delta’s Atlantic revenue fell 2% and Latin America revenue declined 3%, driven by weaker main cabin bookings and lower demand for Mexico leisure travel. These trends suggest that while premium and corporate demand are robust, mass-market discretionary spending remains uneven.

A Bellwether With Limits

Investors often treat Delta’s results as a proxy for consumer health, given that air travel correlates with discretionary and business spending. Historically, a strong Delta quarter signals solid household confidence and healthy corporate travel budgets.

However, this quarter’s performance highlights a growing bifurcation in consumer behavior. Affluent travelers continue to spend on premium experiences, while middle-income consumers, the core audience for budget airlines, are scaling back. This dynamic echoes broader retail trends, where luxury brands outperform discount chains.

So while Delta’s results paint a bright picture for high-end demand, they may not translate to a broader surge in consumer spending across the economy.

Delta’s Long-Term Flight Path Looks Strong

Delta Air Lines (NYSE: DAL) remains well-positioned for sustainable growth. Strengthening cash flow, moderating debt, and a focus on premium travel and operational efficiency underpin profitability. Global partnerships with Air France-KLM, Virgin Atlantic, and LATAM diversify revenue, reduce regional risk, and support long-term earnings stability..

The Takeaway: Buy Delta, Not the Entire Market

Delta’s third-quarter results reaffirm its status as the industry’s gold standard. Yet, investors should resist the temptation to treat its strength as a reflection of the entire economy. This is Delta’s story, not a macro story.

As analysts summarize, Delta’s earnings are a testament to operational excellence, premium strategy, and disciplined execution. The broader market may not share those same tailwinds.

For investors seeking exposure to the airline sector, Delta Air Lines stands out as a buy, but as for the rest of the market, the skies may not be quite as clear.