The world of stablecoins has become a cornerstone of the modern cryptocurrency ecosystem, powering everything from DeFi lending and on-chain savings to cross-border payments and payroll services. For investors seeking safety and predictability amid volatile markets, Dai (DAI) and Ethena USDe (USDE) stand out as two popular options. However, despite their shared goal of maintaining a $1 peg, these stablecoins employ very different strategies to achieve stability.

Tarillium analysts explore the key distinctions between Dai and Ethena USDe, providing guidance for investors weighing risk, yield, and security in the current crypto landscape.

ETHENA USDe: Yield-Oriented, Delta-Neutral Stability

Ethena USDe is a synthetic stablecoin designed to maintain a $1 value through unconventional means. Unlike traditional stablecoins backed by fiat or large crypto reserves, Ethena combines small cryptocurrency holdings (such as Ethereum and Bitcoin) with short futures positions in the same assets. This delta-neutral strategy ensures that gains or losses in the underlying assets are counterbalanced, allowing Ethena to remain stable even during sudden market shocks.

Investors in Ethena can stake their holdings to earn variable returns, offering a 5.5% yield as of October 12, 2025, with historical averages reaching 19% in 2024. This makes Ethena particularly appealing to investors willing to accept higher risk in exchange for the potentially richer rewards that come from participating in newer, experimental financial models.

DAI: Proven Stability and Decentralized Governance

By contrast, Dai (DAI) takes a more conservative approach to stability. It is a decentralized stablecoin that is overcollateralized with crypto assets, mainly Ethereum and other stablecoins like USDC. When new Dai is minted, the user deposits more value in collateral than the DAI issued, and if the collateral’s value falls below a safe threshold, automated liquidation occurs to preserve the peg.

Dai operates under the governance of the MakerDAO community, meaning no single company or individual controls its reserves. This decentralized framework offers transparency and resistance to censorship, appealing to conservative crypto investors who prioritize security over yield.

Dai holders can deposit tokens into the Dai Savings Rate (DSR) program, which provides variable yields that adjust based on market demand and governance votes. Currently, the DSR offers a 1.5% yield, reflecting a more modest but stable return compared to Ethena’s staking model.

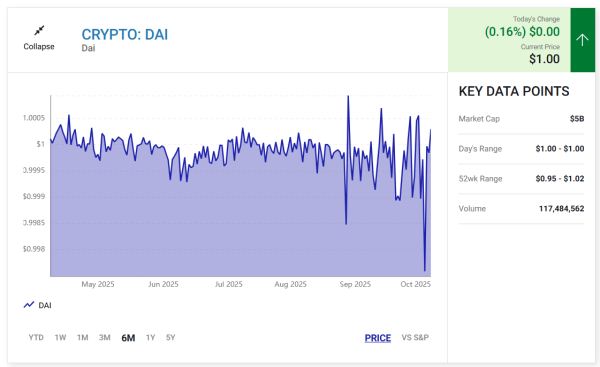

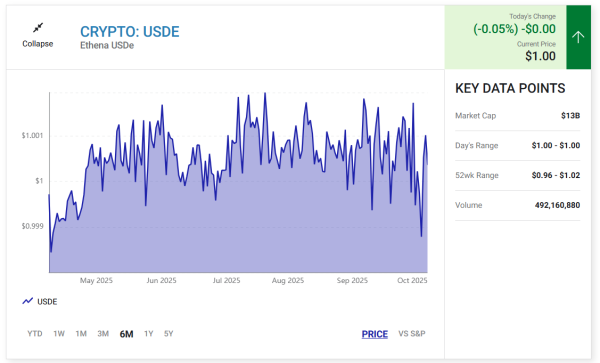

How These Stablecoins Performed During Market Stress

Recent market turbulence highlights the practical differences between these stablecoins. On October 10, 2025, a flash crash triggered by tariff-related concerns caused a temporary panic in the crypto markets, erasing billions in leveraged positions.

Dai responded with minimal volatility, rising to $1.0015 before quickly stabilizing. Ethena USDe, while slightly more reactive, dipped to $0.9912 but recovered within about an hour. By contrast, major cryptocurrencies like Bitcoin and Ethereum saw declines exceeding 5%, illustrating how both Dai and Ethena provide a safe harbor in times of extreme market stress.

This performance underscores that both stablecoins can fulfill the core objective of maintaining price stability, but the choice between them depends on the investor’s risk tolerance and appetite for yield vs. security.

Choosing the Right Stablecoin for Your Portfolio

Investors seeking higher yields and willing to explore innovative mechanisms may prefer Ethena USDe. Its staking model and delta-neutral strategy provide a way to earn significant returns, but with exposure to the risks associated with less conventional financial structures.

Those who prioritize capital preservation and predictability will likely lean toward Dai, where the overcollateralization system and decentralized governance offer long-term reliability, even if yields are lower. Dai’s design also appeals to crypto purists who value transparency and decentralization over aggressive profit-seeking.

In essence, choosing between these stablecoins is not simply a matter of picking the “better” coin; it’s about aligning the asset with your financial goals, risk appetite, and market outlook.

Takeaways from Last Week’s Market Volatility

The October 10 flash crash demonstrates the importance of robust risk management in cryptocurrency investing. Both Dai and Ethena USDe handled the volatility far better than the broader market, proving that stablecoins can act as a hedge during periods of heightened uncertainty.

Even amid temporary blips, these coins preserved their $1 peg, providing a reliable vehicle for trading, lending, and holding liquidity in turbulent times. For investors, this reinforces the value of incorporating stablecoins into a diversified cryptocurrency strategy, particularly for short-term stability or emergency liquidity.

Conclusion: Stability vs. Yield

Dai and Ethena USDe serve distinct roles in the crypto ecosystem. Ethena offers higher yields and exposure to innovative financial engineering, while Dai provides proven stability and decentralized governance. Both handled recent market stress effectively, though they cater to different types of investors.

Analysts recommend evaluating your risk tolerance and investment horizon before choosing between the two. While neither stablecoin is a traditional growth asset, they each offer unique benefits that complement broader crypto or investment portfolios.