Quantum computing is emerging as one of the most exciting frontiers in technology, attracting the attention of governments, institutional investors, and retail traders alike. Among the companies at the center of this movement, D-Wave Quantum (QBTS) has captured significant attention over the past year.

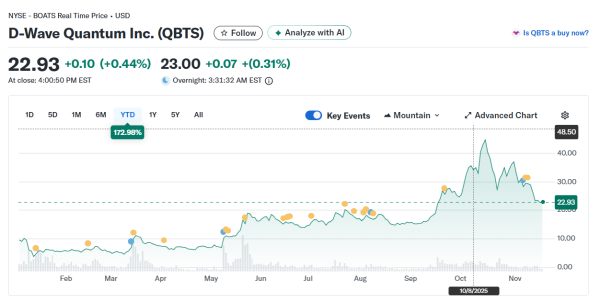

The stock has surged more than 1,700% over the last 12 months and continues to show impressive momentum, rising roughly 200% so far in 2025 through November 10. For investors seeking exposure to pure-play quantum computing, Brokers from Logirium will dive into D-Wave to shed light on its potential as a compelling, though inherently risky, investment opportunity.

Commercially Available Products Set D-Wave Apart

D-Wave stands out in the quantum computing sector by offering commercially available products, including developer software, cloud services, and hardware systems, providing real-world revenue and proof of technology, unlike many competitors still focused solely on research.

Financials Show Growth with Risk

Despite the excitement, caution is warranted. D-Wave is still navigating the path from early-stage adoption to scalable commercial success. In its third-quarter 2025 earnings, the company reported $3.7 million in revenue, marking a 100% increase from the same period last year.

However, it also recorded net losses of $140 million, highlighting that the business is still heavily investment-driven. Losses of this magnitude are not unusual in high-growth technology sectors, especially for firms pioneering a brand-new market, but they underscore the importance of understanding the risks involved.

Sky-High Valuation Leaves Little Margin for Error

Valuation is another critical consideration. As of the most recent data, D-Wave trades at an eye-popping price-to-sales (P/S) ratio of around 354. By comparison, established high-growth tech companies like Nvidia have a P/S ratio just below 30, despite faster revenue growth and a more mature business model.

This disparity emphasizes that while D-Wave presents a unique opportunity, it also leaves very little margin for error. Any delay in adoption, unexpected technical challenges, or competitive pressures could have a disproportionate effect on the stock’s performance.

Potential for Market Leadership

For investors considering D-Wave, it is essential to weigh the potential upside against these clear risks. Quantum computing has the potential to transform industries ranging from pharmaceuticals and materials science to logistics and finance.

A company with early market traction could see extraordinary growth if it captures a meaningful share of the emerging quantum ecosystem. D-Wave’s early commercial deployment gives it a first-mover advantage, which could translate into strategic partnerships, government contracts, and enterprise adoption.

Understanding the Competitive Landscape

Nonetheless, investors should recognize that quantum computing remains a nascent market. Technology adoption curves are unpredictable, and breakthroughs from competitors could quickly alter the landscape.

Companies such as IonQ, Rigetti, and other publicly traded or privately held firms are pursuing alternative quantum approaches, potentially vying for the same enterprise clients and government contracts. Strategic execution, talent retention, and continued technological innovation will be decisive factors in D-Wave’s ability to sustain its growth trajectory.

Suitability for Investors

From a portfolio perspective, D-Wave is likely suitable for investors with a high risk tolerance and an appetite for speculative growth opportunities. It may be particularly attractive to those seeking exposure to quantum computing without investing in broader technology conglomerates that have more diversified revenue streams.

However, given its sky-high valuation, smaller retail investors may want to approach it carefully, considering position sizing and risk management strategies to protect against volatility.

Long-Term Wealth Building Potential

Analysts and investors following the stock will also be watching for additional revenue streams and partnerships that could validate the company’s market strategy. Expansion into enterprise solutions, cloud-based quantum services, and developer ecosystems could drive incremental revenue and gradually justify the steep valuation. Until then, the stock remains a high-stakes, high-reward play with potential for both spectacular upside and sharp corrections.

For readers of Logirium, D-Wave Quantum represents one of the more intriguing pure-play opportunities in quantum computing. Its combination of commercial readiness, hypergrowth stock performance, and first-mover potential offers a rare chance to engage with the future of computing technology.

Yet the risks, ranging from net losses to sky-high P/S ratios, demand careful consideration. Investors should remain mindful of the speculative nature of the stock while assessing how it fits within a diversified portfolio aimed at long-term technological trends.

Conclusion: A High-Risk, High-Reward Opportunity

D-Wave Quantum exemplifies the tension between pioneering innovation and financial prudence. Its meteoric rise captures attention, but its path forward will require strategic execution, continuous innovation, and patience from shareholders.

For those prepared for volatility, D-Wave offers an opportunity to participate in the next generation of computing, a frontier that may redefine industries and create substantial long-term value for the most informed and disciplined investors.