Digital asset markets experienced severe turbulence as risky tokens plummeted to levels unseen since pandemic-era lows. The cryptocurrency selloff intensified concerns about speculative excess and regulatory scrutiny.

Bitcoin and major altcoins suffered synchronized declines reflecting broad-based risk aversion among digital asset participants. A digital asset analyst at Tarillium investigates the factors behind this cryptocurrency market upheaval and potential implications.

Widespread Token Declines

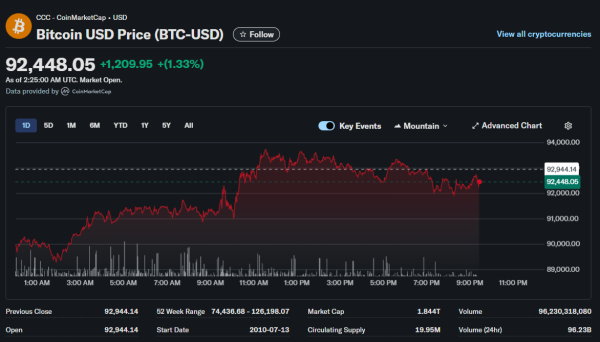

Major cryptocurrencies registered substantial percentage losses as selling pressure mounted throughout trading sessions. Bitcoin, the largest digital asset by market capitalization, fell below psychologically significant price thresholds. Ethereum similarly struggled, declining more sharply than Bitcoin in percentage terms.

Alternative cryptocurrencies, often termed altcoins, suffered even more dramatic declines. Smaller tokens with limited liquidity experienced outsized volatility as thin order books amplified price movements. The risk-off sentiment particularly impacted newer tokens lacking established track records.

Meme coins and highly speculative tokens bore the brunt of the selloff. These assets, which often lack fundamental utility, proved most vulnerable to sentiment shifts. The decline in speculative tokens suggested investors reassessing risk tolerance.

Regulatory Pressure Mounts

Increased regulatory attention contributed to cryptocurrency market weakness. Authorities in multiple jurisdictions announced enhanced oversight initiatives targeting digital asset markets. These regulatory developments created uncertainty about future operating environments for crypto businesses.

Enforcement actions against prominent cryptocurrency exchanges heightened compliance concerns. Regulatory bodies have pursued cases alleging securities law violations and insufficient consumer protections. Such actions prompt investors reconsidering exposure to potentially vulnerable platforms.

Proposed regulations addressing stablecoins and decentralized finance protocols added to uncertainty. Clarity about regulatory frameworks remains elusive despite industry appeals for definitive guidance. This ambiguity weighs on investor sentiment.

Macroeconomic Factors

Broader financial market conditions influenced cryptocurrency performance significantly. Risk assets generally faced pressure amid economic uncertainty and monetary policy concerns. Cryptocurrencies, often viewed as speculative investments, proved particularly sensitive to risk appetite changes.

Interest rate expectations shaped digital asset valuations. Higher rates typically pressure assets lacking cash flows or dividends. Cryptocurrencies fit this profile, making them vulnerable to rate-driven valuation adjustments.

Dollar strength created headwinds for dollar-denominated crypto assets. A firmer greenback typically correlates with weaker cryptocurrency prices. This inverse relationship has proven fairly consistent across various market environments.

Leverage Liquidations

Forced liquidations of leveraged positions amplified downward price pressure. Cryptocurrency derivatives markets allow substantial leverage, which magnifies both gains and losses. When prices decline, leveraged long positions face margin calls triggering automated selling.

These cascading liquidations create feedback loops where selling begets more selling. Price declines trigger liquidations, which drive prices lower, causing additional liquidations. This dynamic can produce violent short-term moves disconnected from fundamental developments.

Funding rates in perpetual futures markets reflected the liquidation cascade. These rates turned sharply negative as long position holders were forced to pay shorts. Such dynamics typically coincide with capitulation phases.

Exchange Stability Concerns

Questions about cryptocurrency exchange financial health contributed to market unease. Previous exchange failures have resulted in complete customer fund losses. Memories of these episodes resurface during market stress periods.

Proof-of-reserves disclosures aim to provide transparency about exchange solvency. However, these attestations don’t constitute full audits and leave meaningful gaps in verification. Sophisticated investors recognize these limitations.

Exchange token prices declined sharply, potentially signaling concerns about platform viability. These tokens often serve as barometers for exchanging health perceptions. Weakness in exchange tokens can become self-fulfilling.

Institutional Participation

Institutional investor behavior appeared to shift during the selloff. Some evidence suggested reduced institutional buying after months of accumulation. This change in flow dynamics removed important price support.

Cryptocurrency exchange-traded products experienced outflows as investors reduced exposure. These regulated investment vehicles had attracted substantial assets during optimistic market phases. Reversing flows indicated changing institutional sentiment.

Corporate treasury holdings of Bitcoin faced renewed scrutiny. Companies holding significant cryptocurrency reserves saw their stock prices pressured. Shareholders questioned the wisdom of maintaining volatile digital assets on balance sheets.

DeFi Protocol Stress

Decentralized finance protocols encountered challenges as collateral values declined. These platforms enable lending and borrowing using cryptocurrency collateral. Falling collateral prices trigger liquidation mechanisms designed to protect lenders.

Stablecoin mechanisms came under pressure testing their ability to maintain dollar pegs. Algorithmic stablecoins particularly faced scrutiny given past spectacular failures. Even well-established stablecoins experienced temporary deviations from parity.

Liquidity pools in decentralized exchanges saw significant withdrawals. Providers removing liquidity reduced market depth, potentially amplifying future volatility. This liquidity extraction can become self-reinforcing.

Recovery Prospects

The path to market recovery remains uncertain given multiple headwinds. Regulatory clarity would remove significant uncertainty but seems unlikely near-term. Macroeconomic conditions need improvement to support risk asset rebounds.

Long-term cryptocurrency believers view current prices as accumulation opportunities. This perspective requires conviction about blockchain technology’s transformative potential. Patient capital historically has been rewarded through multiple cycles.

However, extended bear markets even committed believers’ resolve. Previous crypto winters lasted years before meaningful recoveries materialized. Current participants must prepare psychologically for potentially prolonged weakness before any sustainable recovery emerges.