Crypto payments are surging in 2020, as market data shows more investors spendings vs HODling. For the longest time, the narrative in crypto was that everybody was HODLing opposed to using their crypto assets on real world products and services. According to a poll that included 35,000+ blockchain investors, 70% of respondents have spent cryptocurrency in the last 12 months. What are investors spending cryptocurrency on, and how much are they spending?

Crypto Spending Report

According to a recent press release, BlockCard and Bitcoin Market Journal teamed up to collect market data from 35,000+ blockchain investors. In an environment where it was believed that most crypto investors were “HODling,” the results were quite interesting. According to the poll, 70% of investors stated that they have spent cryptocurrency over the last 12 months. With a survey of this size, it is becoming evident that cryptocurrencies are no longer a genuine buy and hold asset class.

Crypto Payments – Where Are Investors Spending?

In the earlier days of Bitcoin, it was not out of the ordinary to see a few online retailers accepting crypto payments. From a payments standpoint, the industry has still had a difficult time scaling due to larger retailers not supporting digital assets.

As the market continues to mature, various companies in the crypto space like BlockCard and BitPay are driving awareness – interconnecting the traditional world with the digital world. According to a recent report by BitPay, merchants supporting cryptocurrencies are experiencing significant growth this year.

Spending Categories

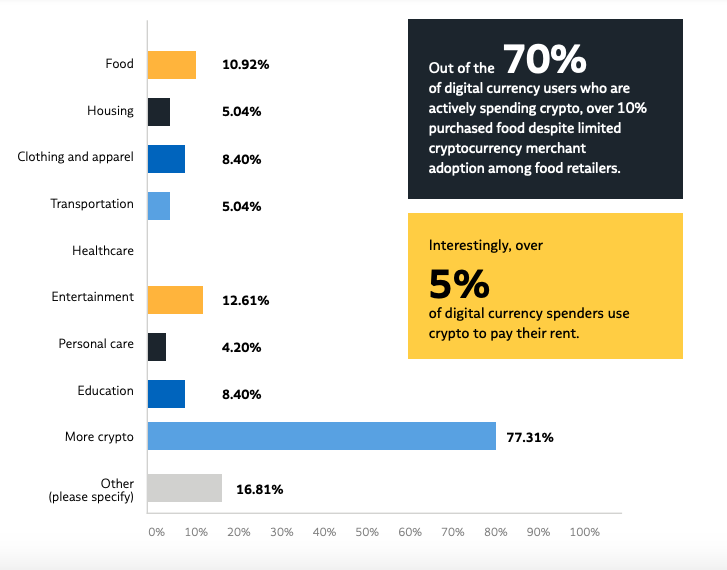

In the recent poll, 11% of respondents were spending their cryptocurrency on food, and 12% were spending on entertainment. A majority of investors ( 75% ) were leveraging digital exchanges and spending their holdings on different cryptocurrencies.

One of the most interesting categories was rent. According to the study, about 5% of respondents were spending their crypto on rent. With cryptocurrencies having significantly higher upside than traditional currencies, it is believed that renters are trying to save money by paying their rent in crypto if the asset is appreciating.

Based on the full spending report, the figure below shows other categories that investors were spending crypto on.

Alex Lielacher, editor of Bitcoin Market Journal commented on the results stating that:

“The takeaway is clear – from paying for essentials to covering education costs, cryptocurrency holders are using digital currencies as everyday currencies.”

Ian Kane from BlockCard also added that:

“While many bitcoin thought leaders preach HODLing as the only way to interact with bitcoin, data suggests that digital currency holders are actually using their ‘magic internet money’ as money.”

Spending Habits

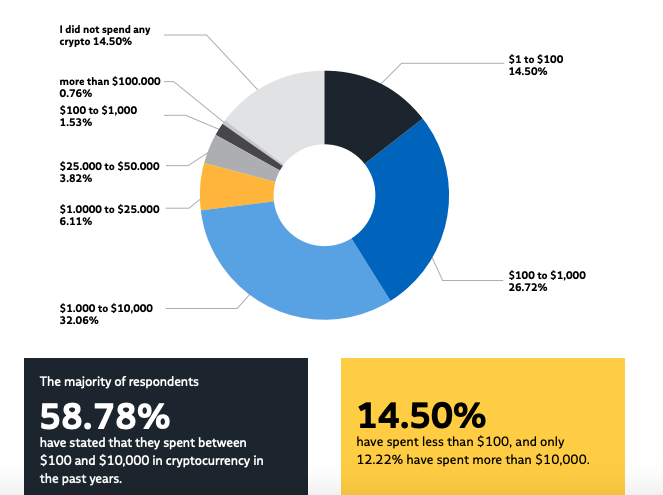

Studying spending habits can be important, because it shows us how serious the transition into crypto payments may be. According to the data, about 32% of respondents spent between $1,000 and $10,000. This is significant and goes to show that people are not only spending their cryptocurrency on micro transactions. Only 14.50% of investors have spent less than $100 over the last 12 months.

Summary

The recent survey conducted by BlockCard and Bitcoin Market Journal is showing that cryptocurrencies are evolving into more than just store of value assets. By looking at the financial behavior of 35,000+ blockchain investors, it is apparent that consumers are finding value in crypto payments.

This is all occurring in an environment where regulation and tax code are still in pre-maturation. As the industry becomes more transparent, crypto payments should experience rapid velocity as merchants get more comfortable implementing crypto into their infrastructure.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.