Crypto markets added $15 billion last week, with Bitcoin rallying +5.7%. U.S equities closed a six week low as the technology sector continues to experience sell-offs. With the Federal Reserve planning to keep interest rates near 0% through 2023, how could this affect Bitcoin price action in the short term?

Crypto Markets

Global crypto markets added $15 billion last week with total market capitalization hovering around $351 billion. Bitcoin finished the week +5.76%, with dominance levels sitting at 57.4%. Bitcoins market dominance gained around +1% last week as various altcoins experienced bearish price action, causing investors to allocate more “safe haven” exposure to Bitcoin.

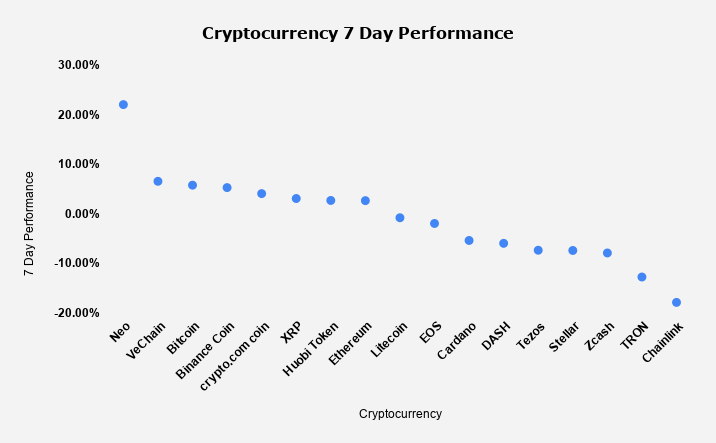

Crypto markets outliers – Neo And VeChain

When looking at some of the top cryptocurrencies by market cap, Neo and VeChain were the weekly outliers, with Neo seeing double digit gains.

In regards to Neo, many investors seem to have their eye on “Flamingo Finance,” which is a DeFi protocol built on Neo that is due to launch later this month. With DeFi seeing significant growth this year, Flamingo Finance seems to be drawing attention due to its interoperability with different blockchain networks. With the rally last week, Neo has now surged +55% over the last month.

In regards to VeChain, the project continues to prove why its blockchain is catching on to real world utility. As recently reported by Visionary Financial, VeChain has joined the CAFA, which is an organization backed by the China government. With becoming a council member in the China Animal Health & Food Safety Alliance, Vechain will look to leverage its blockchain for a food traceability system in the region. Over the last year, VeChain has surged +228%

Bitcoin Vs US Dollar

For over a month now, Visionary Financial has been following the Dollar Index. If we follow bitcoins price action historically, we can see how they are inversely correlated. With the Federal Reserve planning to keep rates low for years, plus pumping up inflation, it has thrown a curve ball at the Dollar. This is why we believe that the Federal Reserve will essentially fuel the next Bitcoin rally.

Even though we continue to share this chart, it will be important to follow the Dollar Index in the near term. With uncertainties still mounting around inflation, interest rates, and economic recovery, the Dollar has more room to fall. Based on historical metrics, Bitcoin has thrived in this environment. According to Larry Fink, the CEO of Blackrock, he sees the US Dollar, deficits, and inflation being some of the biggest concerns moving forward for traditional markets.

Bitcoin Technical Analysis

At the time of this report, Bitcoins price is currently trading at $10,952. We continue to watch the $10,600 support level. If Bitcoins price does not dip below that level, we believe that BTC will ultimately attempt to test resistance at $12,500 in the near term.

Unfortunately this could very well depend on the direction of the Dollar as discussed above. Even though many would love to see Bitcoin trade in its own direction, that environment just is not relevant right now. BTC continues to be highly correlated to the Dollar. It is important to note that this is not always the case. BTC could very well go on its own bull run like it has done many times before. On the downside, if Bitcoins price fails to hold $10,600 support, traders will be looking for a test at $9,200 support.

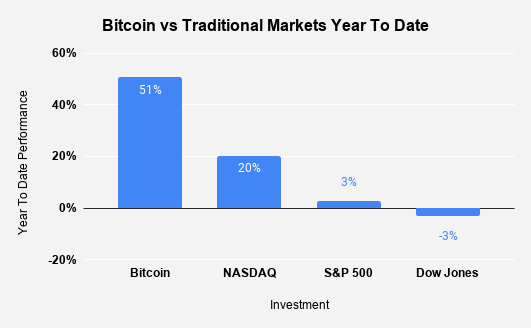

Bitcoin Vs Traditional Markets YTD

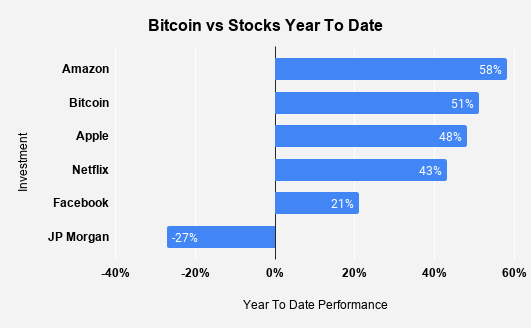

Bitcoin Vs Stocks YTD

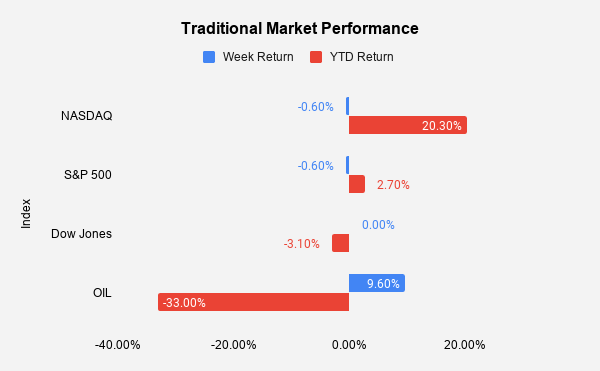

Traditional Markets

Stocks closed at their 6 week lows, which was fueled by the continued sell-offs in the technology sector. The Dow Jones was flat on the week at 0%. Both the NASDAQ and S&P 500 fell -0.60%.

Despite stocks cooling off the last month, people can not forget the incredible comeback the markets have experienced since COVID19 lockdowns. Over the last 6 months, the market has rallied +50%. Despite some states taking longer than others to reopen, the market has been looking at consumer data to gauge economic activity.

With GDP being consumed of nearly 70% household spending, these metrics are helping the market assess economic conditions. Last week, data around the individual consumer continues to show improvement. Aside from the NAHB home builder index going up for the 5th month in a row, initial jobless claims also continued to fall to levels not seen since March. On the spending side of things, U.S. retail sales have now been going up for 4 months in a row.

Despite economic conditions on the rise, investors should still be prepared for market volatility, especially in an environment where the presidential election is only a month and a half away.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice. This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.