A Sudden Shock to the System

On Oct. 10, the cryptocurrency market suffered a stunning flash crash that erased hundreds of billions in market capitalization within minutes. Triggered by an unexpected announcement from the current U.S. President threatening higher tariffs on China, the event sent shockwaves through both centralized and decentralized exchanges.

While the market has since stabilized, the episode served as a stress test for the crypto ecosystem, exposing the vulnerabilities of excessive leverage, thin liquidity, and dependence on unregulated trading structures.

According to Tarillium financial analysts, events like this are a reminder that while volatility is intrinsic to crypto markets, the system’s reaction to leverage and liquidity shocks remains a critical weak point that long-term investors must understand.

What Actually Happened

The tariff announcement initially appeared unrelated to cryptocurrencies. However, traders, already nervous about macroeconomic uncertainty, responded with panic selling. Within minutes:

- Bitcoin (BTC) plunged more than 12% from its recent peak.

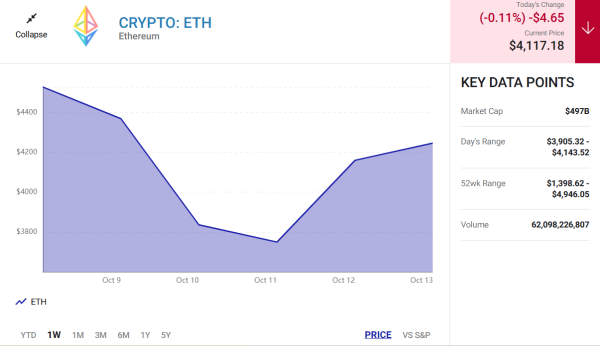

- Ethereum (ETH) dropped even further.

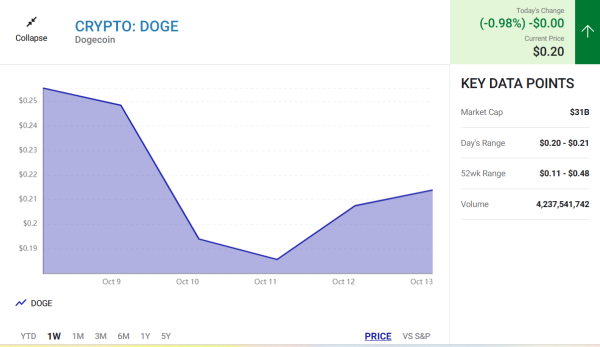

- Dogecoin (DOGE) briefly lost 50% of its value before stabilizing.

- Altcoins outside the major names were devastated, with some losing up to 99.9% of their market value.

Data from CoinDesk showed that non-Bitcoin and non-Ethereum assets saw an average decline of 33%, one of the sharpest collapses in digital asset history.

The Real Culprit: Leverage and Liquidations

At the heart of the crash was leverage, specifically, the widespread use of highly leveraged perpetual futures across both decentralized (DEX) and centralized exchanges (CEX).

As prices began to slide, automatic liquidation mechanisms kicked in. Roughly $19 billion in leveraged positions were force-sold in a matter of hours, the largest single-day liquidation on record. Each forced sale created downward momentum, which triggered further liquidations in a vicious cascade.

Liquidity also evaporated. Market makers, alarmed by the pace of the selloff, pulled back from quoting prices on smaller tokens. As a result, order books thinned out dramatically. Even modest selling pressure led to air-pocket pricing, where assets dropped 20–50% in seconds simply because no buyers remained.

Some exchanges also suffered oracle failures and disruptions in the data feeds that track price accuracy, which intensified fear and confusion across platforms.

Allegations and Market Manipulation Fears

Adding intrigue to the chaos were unconfirmed allegations that an insider may have shorted Bitcoin ahead of the U.S. President’s tariff comments, profiting an estimated $200 million during the crash. While there is no hard evidence yet, the timing and trading volume patterns mirror previous suspicious activity during similar market-moving events.

Regardless of whether manipulation occurred, the market’s reaction made one thing clear: Crypto’s structure amplifies shocks. Even small triggers can cause disproportionate market movements when leverage and thin liquidity collide.

Lessons for Long-Term Investors

While the crash rattled confidence, it also offered a playbook for smarter investing in volatile markets. Here are three key takeaways:

1. Avoid Leverage at All Costs

Leverage magnifies both gains and losses, but in crypto, the speed of liquidations can wipe out portfolios in minutes. Even modest 2× leverage left many investors insolvent during the crash. Unless you are a professional trader with deep risk controls, leverage in crypto is simply not worth the downside.

2. Stick to Blue-Chip Cryptos

During the flash crash, Bitcoin and Ethereum held up far better than smaller altcoins. Both assets have deep liquidity, institutional support, and credible long-term adoption theses. Other large-cap projects such as Solana (SOL), XRP (XRP), and Chainlink (LINK) also rebounded quickly.

These are the assets investors should anchor their portfolios around: coins with clear utility and resilience in extreme conditions.

3. Focus on the Multi-Year Thesis

Crypto’s long-term story remains intact. Adoption, infrastructure development, and policy clarity are expanding globally. The volatility of October was a short-term liquidity event, not a structural collapse. Investors who stay focused on fundamentals rather than short-term noise will be better positioned for the next bull cycle.

The Road Ahead

In the aftermath, markets have largely recovered, but trust and risk management are now front and center. Exchanges are reassessing collateral requirements, and regulators are likely to intensify scrutiny of leveraged crypto products.

For investors, the lesson is both simple and timeless: Risk is the price of opportunity. Understanding where that risk hides in leverage, liquidity, or complexity is what separates the survivors from the casualties.

Crypto remains a transformative asset class, but it’s not for the faint of heart. The Oct. 10 flash crash was a brutal reminder that innovation doesn’t cancel out volatility. However, for disciplined investors who prioritize quality and patience, the storm also revealed something deeper: the market’s capacity to reset, adapt, and ultimately strengthen after the fall.