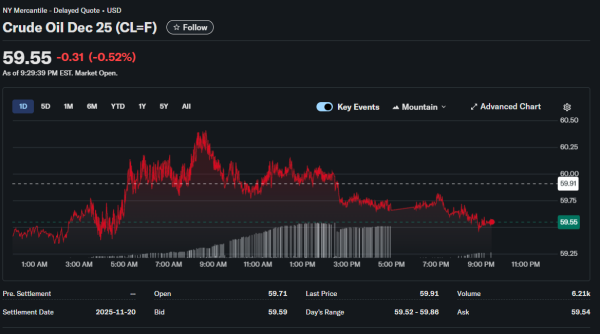

Oil prices found stability following substantial volatility during earlier trading sessions. Supply worries and demand ambiguity generated contradictory forces affecting energy markets. Market participants anticipate clearer direction on OPEC output choices and worldwide economic expansion outlook.

A commodities analyst at LFTrade evaluates the elements influencing petroleum market movements.

Production Management Continues

OPEC alongside its partners persist in administering output quotas aimed at sustaining price levels. Latest gatherings have preserved existing production volumes notwithstanding certain participants advocating expansions. The organization confronts obstacles weighing income requirements against market portion worries.

Saudi Arabia has spearheaded initiatives to uphold production restraint. The monarchy depends substantially on petroleum income for state expenditures. Diminished valuations endanger budgetary steadiness despite attempts to broaden the economy past oil reliance.

Alternative producers including Russia have convoluted OPEC’s synchronization attempts. Penalties on Russian petroleum have interfered with typical market operations. Russia has located substitute purchasers but frequently at reduced valuations compared to standard crude.

Consumption Outlook Mixed

Worldwide petroleum appetite expansion has decelerated from earlier peaks. China’s economic cooling has diminished its intense hunger for crude shipments. The planet’s biggest oil purchaser has witnessed manufacturing activity slow as real estate sector difficulties persist.

American appetite has stayed comparatively sturdy bolstered by economic expansion. Nevertheless, climbing interest charges endanger slowing activity and diminishing gasoline usage. The approaching travel season will furnish crucial indicators about American buyer conduct.

European appetite has been feeble amid economic stagnation and elevated energy valuations. Manufacturing activity stays subdued throughout considerable portions of the region. Germany especially has grappled with industrial contraction that diminishes diesel fuel usage.

Regional Conflict Considerations

Middle Eastern strains keep contributing a danger premium to petroleum valuations. Disputes in the territory endanger potential supply interruptions from significant producers. Markets stay worried about situations that could eliminate meaningful production volume from worldwide markets.

Nevertheless, genuine supply interruptions have been restricted notwithstanding continuous disputes. Producers have upheld output even as security dangers persist. This has progressively diminished the danger premium as markets become habituated to raised strains.

Potential interruptions to navigation passages constitute continuing worries. Critical maritime passages like the Strait of Hormuz transport enormous petroleum quantities daily. Any obstruction with these pathways could activate abrupt valuation surges regardless of genuine production heights.

Reserve Stock Decisions

American Strategic Petroleum Reserve choices affect market movements. Earlier discharges assisted moderating valuations during supply worries. The reserve has been somewhat replenished but stays substantially beneath historical heights.

The government confronts choices about rhythm and velocity of reserve restoration. Acquiring petroleum for the reserve bolsters valuations but escalates administration expenses. Weighing these factors while administering gasoline valuations for buyers generates political difficulties.

Alternative nations uphold strategic reserves that could be implemented during supply crises. Synchronized discharges from numerous nations magnify market influence. Nevertheless, reserves constitute limited resources that cannot indefinitely substitute production volume.

Processing Limitations

Refining volume has transformed into a constriction restricting fuel provisions. Years of insufficient funding have abandoned refiners grappling to satisfy appetite peaks. Refinery upkeep and unexpected shutdowns worsen constrained supply circumstances for gasoline and diesel.

The shift toward purer fuels has convoluted refining functions. Fresh requirements necessitate supplementary processing stages and capital allocation. Certain aged refineries have terminated instead of executing mandated enhancements.

Regional differences in refining volume generate valuation disparities throughout markets. Territories with inadequate regional refining must import completed merchandise at elevated expenses. This adds to geographic valuation fluctuations vexing buyers.

Electric Transportation Influence

Expanding electric automobile embrace is commencing to influence extended-term petroleum appetite forecasts. Transportation constitutes the biggest origin of petroleum usage worldwide. EVs straightforwardly diminish gasoline appetite though the influence stays modest presently.

Predictions for maximum petroleum appetite fluctuate broadly contingent on EV embrace presumptions. Hopeful situations imply appetite could culminate within the present decade. More cautious perspectives witness appetite persisting to expand albeit at reduced velocities.

Petroleum producers are observing EV movements deliberately while upholding allocation in production volume. The ambiguity about appetite direction convolutes extended-term preparation choices. Corporations must weigh preparing for energy shift while satisfying immediate supply requirements.

Dollar Relationship

Petroleum exchanges in dollars worldwide, generating significant currency associations. A firmer dollar renders petroleum more costly for purchasers employing alternative currencies. This can diminish appetite marginally while rendering dollar-valued commodities less appealing to participants.

Latest dollar vigor has generated obstacles for petroleum valuations. The Fed’s comparatively firm position bolsters the currency. Alternative central authorities seeking looser strategies have witnessed their currencies diminish against the dollar.

Petroleum producers profit from dollar vigor to the degree their expenses are in regional currencies. Nevertheless, this benefit lessens if appetite destruction from elevated valuations diminishes quantities. The currency-commodity connection generates intricate response circles.

Direction Stays Ambiguous

Petroleum markets confront contradictory indicators generating authentic ambiguity about course. Supply restraint from OPEC bolsters valuations while appetite worries generate descending force. Geopolitical dangers contribute turbulence but haven’t activated genuine supply interruptions yet.

The equilibrium between these elements will establish whether valuations trend elevated or reduced. Economic expansion paths in significant consuming territories matter tremendously. China’s recuperation route especially affects worldwide appetite forecasts.

Immediate-term span exchanging appears probable until clearer directional indicators surface. Valuations likely maintain bolster from OPEC restraint at reduced heights. Appetite worries and economic ambiguity restrict ascending potential. This generates a comparatively limited exchanging span absent significant supply disturbances.