Celo, which is the most actively used DeFi platform, announced that it had received a $20 million investment. The funding came from renowned institutional investors such as Greenfield One, Andreessen Horowitz, and Electric Capital. Thus far, Celo has received over $65 million in funding from various backers such as Coinbase Ventures, and Reid Hoffman.

Celo Soaring To New Heights

The Celo platform was launched in 2017. Since then, the community has launched a Mainnet, a native token called CELO, and a stablecoin called cUSD. Additionally, they launched a mobile payments app. Celo is listed on leading crypto exchanges such as Binance and Coinbase. Over 2 million transactions have been conducted via the Celo network, which makes it one of the most active DeFi payments platforms in the world.

Celo Launches A Global Payments App & It Already Has A Use Case

Celo also announced that it was launching Valora, which is the first mobile remittance and P2P payments app built on Celo. After extensive testing and the success of a pilot program in Q4 2020, Valora will now be accessible globally to anyone with a smartphone. Users of Valora will enjoy transaction fees as low as $0.01 to any part of the world.

The Current State Of The Global Remittance Market

The global remittance market is worth over $500 billion. In the legacy financial system, transaction fees can be as high as 15% of the total transaction. Besides that, these transactions are slow, and they can take days to process.

Valora offers users access to an efficient system where transactions are completed in a few seconds. Since transactions are powered by the Celo platform, remittance fees are extremely low, costing as little as $0.01 per transaction.

Since the beta launch of Valora in September 2020, the app has seen exponential adoption. Its user base currently stands at tens of thousands of users. Most of them are active on a daily or weekly basis. It is accessible in over 100 nations with hundreds of thousands of cUSD transactions already taking place.

About The Valora App

The Valora app is accessible via the Apple Store and Google Play store. It was created by cLabs, which is one of the numerous organizations within the Celo ecosystem. To conduct transactions, users need to fund their account with cUSD. They can then send the funds to anyone in their contact list. The recipient will then receive a text message to redeem their cUSD.

Valora Use Case

The Valora app is already in use by the Grameen Foundation, which uses the app to deliver relief to thousands of people globally impacted by COVID19. Valora has already been used to successfully deliver aid to over 3500 women entrepreneurs in the Philippines who were impacted by COVID19. The cUSD sent to these deserving women were used to meet basic needs such as buying medicine and food.

The growth of the DeFi ecosystem is already having a positive impact on the world, as demonstrated by the launch of Valora. It will help to create a more efficient financial system that is inclusive and efficient.

DeFi Markets

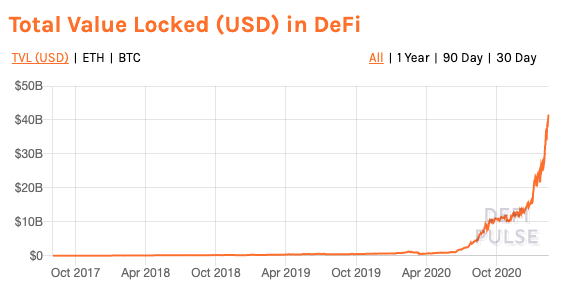

At the time of this article, $41.63 billion is flowing through decentralized finance. Just a few years ago, this market was valued at $1.5M. Many legacy financial solutions such as lending, borrowing, investing, and investing are getting revolutionized through decentralized protocols.

Instead of relying on centralized parties like banks, DeFi is showing the true power in smart contracts through automated enforceable agreements. Unlike traditional banking, DeFi applications are streamlining financial services and opening the door to the banked & unbanked population globally.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however, no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the cryptocurrency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal, or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal, and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article. Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.