Brokers from Orbisolyx dive into the quantum computing frenzy as D-Wave Quantum (NYSE: QBTS) captures investor imagination with a stunning 3,600% surge over the past year. While the company’s long-term technological potential fuels strong speculative interest, questions remain over whether D-Wave’s fundamentals can support such lofty valuations.

Analysts caution that despite impressive growth in quantum-related orders and partnerships, the company is still pre-commercial, burning cash rapidly, and relying heavily on equity raises. The current rally reflects market hype and optimism more than near-term revenue generation, leaving investors to weigh risk versus transformative potential.

Quantum Computing Enters the Spotlight

Once a niche field reserved for academic labs, quantum computing has exploded into the mainstream investment conversation. The breakthrough announcement of Alphabet’s “Willow” quantum chip in late 2024 rekindled hopes that scalable quantum applications may be closer than expected.

The sector’s optimism quickly spilled over into public markets. D-Wave, one of the few pure-play quantum hardware firms, saw its shares multiply several-fold as institutional and retail investors raced to secure exposure to the next frontier in computation.

Founded more than two decades ago and publicly listed through a SPAC merger in 2022, D-Wave has long positioned itself as a pioneer in quantum annealing systems, a subset of quantum computing optimized for solving complex optimization problems.

A Revenue Pop, but Profitability Still Distant

D-Wave’s second-quarter 2025 revenue climbed 42% year over year to $3.1 million, bolstered by a mix of enterprise and research contracts. Recent deals with Lockheed Martin and several academic institutions showcase growing interest in its systems.

However, the numbers tell a sobering story. Operating expenses ballooned to $28.5 million, reflecting heavy investment in R&D and infrastructure. The company continues to rely on equity raises to fund operations, issuing roughly $400 million in new stock in July alone.

This dilution has sharply expanded D-Wave’s share count since 2022, eroding existing shareholder value even as market capitalization soars. Until the company demonstrates a sustainable path toward profitability, that trade-off will remain a persistent headwind.

Valuation Stretched by Quantum Hype

D-Wave’s valuation metrics illustrate the speculative fervor underpinning its rally. With a price-to-sales ratio of 336, the company trades at nearly 100× the S&P 500’s average multiple. While visionary investors may view this as a justified premium for transformative potential, such pricing assumes flawless execution over the next decade, an unlikely scenario for a still-experimental industry.

Even after 14 years of product commercialization since selling its first system to Lockheed Martin in 2011, D-Wave’s business remains in the early adoption stage. The long runway toward mass-market quantum computing means operational scaling and eventual profitability may take years to materialize.

A Millionaire-Maker or a Momentum Mirage?

In the near term, D-Wave’s breathtaking rise cements its reputation as one of 2025’s most explosive trades. For early entrants, it has already been a millionaire-maker. But for new investors, caution is warranted.

Quantum computing’s promise is undeniable, but markets often front-load optimism, pricing in breakthroughs long before the technology or revenues fully arrive. For D-Wave to justify current valuations, it must convert scientific potential into consistent cash flow, while managing dilution and execution risk.

The Orbisolyx Take

Orbisolyx analysts view D-Wave Quantum as an exciting but high-beta speculative play. Its leadership in quantum annealing provides early-mover advantage, yet the company’s capital intensity, weak cash flow, and dilution risk temper its long-term investment case.

While it could one day join the ranks of transformational tech winners, the stock currently reflects future success priced at today’s perfection. For investors seeking quantum exposure, diversification across hardware, cloud, and software-layer players may offer a more balanced risk-reward profile.

Before committing capital, remember that the Orbisolyx Advisor analyst team recently identified 10 top stocks positioned for stronger risk-adjusted returns, and D-Wave Quantum was not among them.

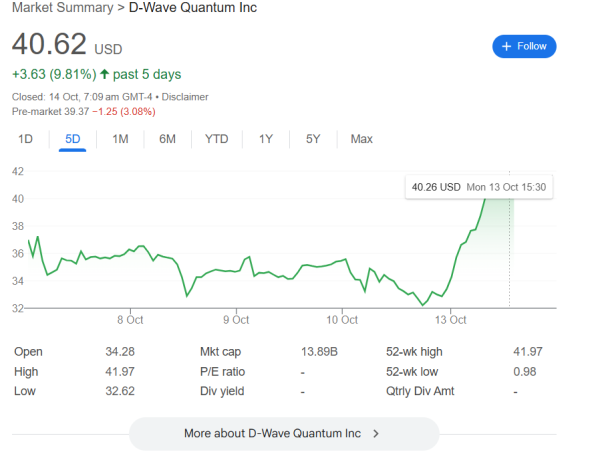

Technical Outlook: Volatility in the Quantum Zone

After peaking near $4.90, D-Wave shares entered a sharp consolidation phase, now hovering around $3.75 as traders lock in profits. Short-term support sits near $3.20, while resistance emerges at $5.00, a psychological barrier reinforced by recent volume spikes.

Momentum indicators suggest the stock remains overbought on the weekly RSI, though intraday charts hint at continued speculative inflows. Should the stock sustain above $4.00, it could retest highs in the $5.50–$6.00 range. Conversely, a breakdown below $3.00 could trigger a swift reversion toward $2.25, where longer-term moving averages converge.

In essence, D-Wave Quantum is trading less on fundamentals and more on narrative momentum, a setup that rewards nimble traders but punishes latecomers. Caution and tight risk management are key until a sustainable trend confirms itself.