Cake DeFi recently announced that it was adding a fiat-crypto gateway. According to a recent press release, the platform will add support for the swapping of 13 major currencies into crypto. To achieve this, the platform has partnered with a leading, internationally-compliant provider of fiat to crypto gateway solutions. Cake DeFi strives to create the most transparent way in crypto to earn high yields on digital asset holdings.

Fiat To Crypto Gateway Solution

With the new solution, Cake DeFi will provide users from over 150 countries with a wide variety of payment options and currencies. All the services will be offered while maintaining an efficient user experience.

How To Use The Fiat Gateway

Users of the Cake DeFi platform will be able to add Ether and Bitcoin to their accounts via debit/credit cards, bank transfers, and other payment methods in a matter of minutes. Users from Canada, Europe, and Australia will enjoy zero fees when using bank transfers.

According to the CEO of Cake Defi, Dr. Julian Hosp, they conducted a thorough analysis before they settled on an option that they believe is user-friendly and affordable for their users. The CEO added that the Cake DeFi platform was not just focused on accelerating crypto adoption. He noted that the platform was empowering users with cash flow on their digital assets. Dr. Hosp concluded by saying that the fiat gateway represented a major achievement in the platform’s growth plans.

To use the fiat gateway, users will have to conduct simple and quick identity verification on their initial crypto purchase. Once they complete the process and deposit funds, users can pick one of the products offered by Cake DeFi and begin earning high yields on their crypto.

About Cake DeFi Platform

Cake DeFi is a transparent and regulated platform that creates innovative products for the crypto world. Their products enable users to earn passive income from their crypto holdings. The platform is registered in Singapore, where the headquarters of its operations are located. It is fully compliant with all the regulations established by the Monetary Authority of Singapore.

Cake DeFi has partnered with the biggest and most trustworthy lenders in the crypto sector. One of their most important partners is Genesis Capital. Through the partnerships, they can provide users with some of the highest yields in the DeFi sector. According to the companies website, they offer the following annual yield:

- Bitcoin: 8.00%

- Ethereum: 9.00%

- USDT: 11%

- DASH: 4.80%

- DFI: 45.50%

- PIVX: 4.40%

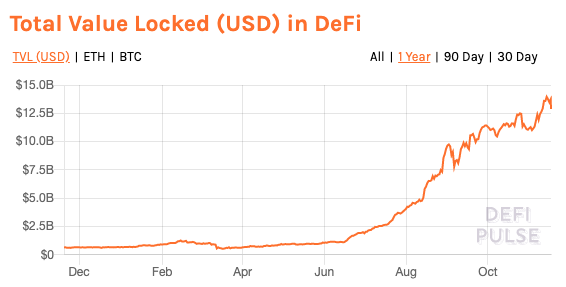

Cake DeFi provides its users with an intuitive platform that gives them the ability to harness the full potential of Decentralized Finance. The platform has a goal of driving the mass adoption of crypto. In an era where central banks are pushing interest rates to 0%, investors have a slim chance of finding yield in traditional banking. This environment has resulted in more than $12 billion being deployed into DeFi protocols across the globe. This figure has grown exponentially since November 2019, when there was $644 million locked in DeFi protocols.

The DeFi sector is still a relatively young sector that has been experiencing explosive growth in the recent past. However, avenues for interactions between DeFi and Centralized Finance are still limited. Platforms such as Cake DeFi help to create crucial bridges between CeFi and DeFi with innovative solutions such as their recently-launched fiat to crypto payment gateway.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.