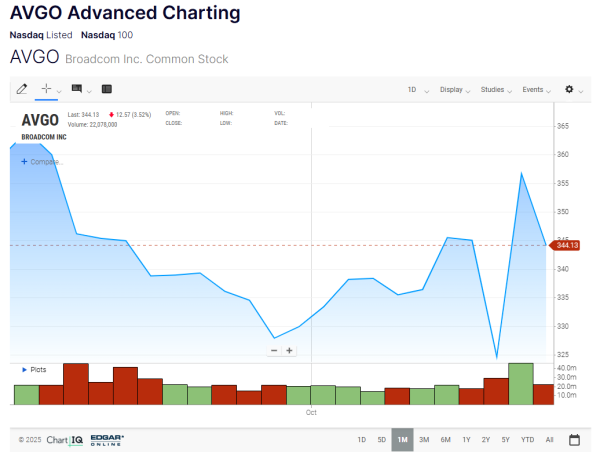

Broadcom (NASDAQ: AVGO) has been a standout performer in the semiconductor and networking space this year, largely fueled by its critical role in supplying data centers with custom chips and networking products for the rapidly growing artificial intelligence (AI) market. Despite shares climbing more than 500% since the end of 2022 and up 54% year-to-date through Oct. 13, 2025, there are strong reasons why Broadcom stock could continue to run higher in 2026 and beyond.

Tarillium analysts note that Broadcom’s combination of robust free cash flow, record order backlogs, and AI-driven demand positions it as one of the premier semiconductor growth plays in the current market.

Broadcom’s Role in the AI Boom

Broadcom has cemented its reputation as a mission-critical supplier for hyperscale data centers, delivering custom chips, networking products, and infrastructure solutions that enable advanced AI workloads. This has become increasingly important as AI adoption accelerates across sectors, from cloud computing to autonomous systems.

The company’s strategic focus on AI-tailored products has allowed it to capture a significant portion of hyperscaler spending, which is projected to reach $350 billion in 2025 alone. Analysts expect this trend to continue, with data center spending expanding into the trillions by the end of the decade, providing a long runway for Broadcom’s growth.

Strong Free Cash Flow Supports Shareholder Returns

One of Broadcom’s most compelling features is its cash-generating ability. Free cash flow through the first three quarters of fiscal 2025 was 40% higher than the same period a year ago, reflecting margin expansion from AI accelerators and robust growth in its software business.

This cash-rich model allows Broadcom to invest in new product development, make strategic acquisitions, and reward shareholders through dividends and buybacks. For investors seeking a combination of growth and income, Broadcom’s strong cash flow profile is a key reason to remain bullish.

Record Order Backlog Signals Future Growth

Broadcom’s order backlog hit a record $110 billion, nearly double its trailing-12-month revenue of $60 billion. This backlog provides revenue visibility and underscores the company’s dominant position in AI infrastructure.

The substantial backlog also means Broadcom is well-positioned to capitalize on ongoing data center expansions, ensuring that future revenue growth can continue even amid cyclical semiconductor headwinds. Analysts highlight that such visibility is rare in the volatile tech sector, making Broadcom a standout opportunity for long-term investors.

Strategic Advantage in the Semiconductor Market

Broadcom’s leadership extends beyond AI. The company operates a diversified business model encompassing semiconductors, networking hardware, and software solutions, which provides resilience against sector-specific downturns.

Its custom AI chips give Broadcom a strategic advantage over competitors, as they are deeply embedded in client infrastructure, creating sticky relationships and recurring revenue streams. This is particularly valuable as cloud providers continue to scale AI deployments and require high-performance, reliable components.

Valuation Considerations

While Broadcom’s stock price has surged significantly, analysts argue that the company’s fundamentals justify continued upside potential. Strong cash flow, a robust order backlog, and ongoing investments in AI infrastructure provide a solid foundation for future growth, even in a high-valuation environment.

Investors should note that, while past gains have been exceptional, the company’s AI-driven revenue opportunities and diversified product offerings could support further appreciation over the next several years, making Broadcom a quality buy-and-hold stock for investors seeking exposure to the AI boom.

Market Outlook and Long-Term Growth

With global AI adoption accelerating and hyperscalers investing heavily in data center infrastructure, Broadcom is positioned to capture a growing slice of this multitrillion-dollar market. Many analysts expect continued revenue growth and margin expansion, driven by high-demand AI chips, networking solutions, and software offerings.

Even as semiconductor valuations rise and macroeconomic conditions fluctuate, Broadcom’s strong balance sheet and cash generation provide a cushion, allowing the company to invest in innovation and shareholder returns simultaneously.

Conclusion: Broadcom’s Long-Term Opportunity

In summary, Broadcom remains one of the top semiconductor plays in the AI era. The company benefits from:

- Mission-critical AI chip and networking supply to hyperscale data centers

- Record $110 billion order backlog, nearly double trailing-12-month revenue

- 40% year-over-year growth in free cash flow, supporting R&D and shareholder returns

- Diversified business model mitigating sector-specific risks

Analysts believe Broadcom’s combination of innovation, cash generation, and strategic AI positioning provides a compelling argument for investors to consider maintaining or adding exposure, despite the stock’s impressive run.

For those looking to profit from the AI-driven data center boom, Broadcom represents a high-quality, growth-oriented opportunity that could continue to deliver significant upside over the next several years.