Four recreational boat manufacturers face rising rates and softer demand as the industry navigates a cyclical downturn.

The recreational boating sector experienced a post-pandemic boom that has now reversed as interest rates climbed and discretionary spending contracts. Rineplex junior financial analyst compares Marine Products, Mastercraft Boat Holdings, Malibu Boats, and Brunswick to identify which companies offer the strongest positioning through current market turbulence.

Industry Context and Headwinds

The recreational boating market represents a fragmented, mature industry facing significant cyclical pressures. Market data shows boat sales for all types declined at a 2.3% compound annual growth rate between 2018 and 2022. However, broader market projections including rentals and tourism suggest growth around 8.69% through 2028.

The sector enjoyed a 13-year sales high in 2020 as consumers benefited from additional leisure time and stimulus income. Global supply chain disruptions plagued the industry during this boom period. Marine Products struggled particularly with these challenges versus competitors like Brunswick and Malibu Boats that maintain stronger vertical integration.

Current Market Dynamics

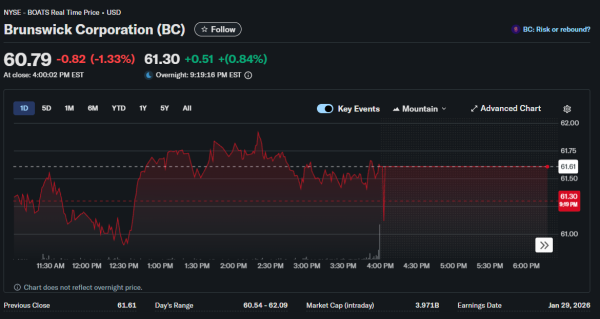

Rising interest rates created substantial headwinds affecting both consumer purchases of discretionary items and dealer carrying costs. All four manufacturers engage in dealer floorplan financing with third-party institutions requiring inventory repurchase if dealers default. Brunswick’s risk appears somewhat mitigated through its own U.S. and Canadian financing operations.

Interestingly, Malibu Boats reported during recent earnings calls that more retail customers now use cash for purchases instead of financing. Consumer trends also indicate preference shifts toward larger boat models despite the challenging economic environment.

Capital Allocation Comparison

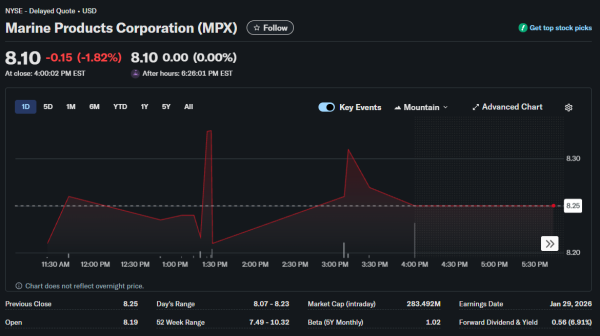

Marine Products demonstrates superior stewardship with zero outstanding debt while maintaining a $20 million credit facility. The company posts a healthy return on capital investment exceeding 44% alongside strong financial metrics. Marine Products and Brunswick both pay quarterly dividends and operate share buyback programs.

Malibu Boats wisely elected to pay down debt instead of repurchasing shares. Its debt-to-equity ratio decreased from 56% pre-pandemic to 11% last year.

In contrast, Brunswick’s debt equity increased from 92% to 122% during the same period. Mastercraft also maintains a share buyback program with collaborative supplier relationships.

Product Market Positioning

Industry discussions among dealers and enthusiasts suggest Cobalt by Malibu Boats holds the dominant premium position alongside privately held Regal. Mastercraft boats rank as luxury offerings positioned above Chaparral. Marine Products’ Chaparral line occupies mid-tier positioning competing directly with Brunswick’s Sea Ray brand.

Comparisons between Chaparral and Sea Ray suggest Chaparral exhibits superior craftsmanship benefiting from Marine Products’ niche focus versus Brunswick’s mass production approach. Chaparral boats offer lighter weight, faster speeds, and better fuel efficiency than Cobalt. However, Cobalt provides more power and smoother rides preferred by veteran enthusiasts.

Brunswick’s Diversification

Brunswick represents the only non-pure play competitor among the four companies. The firm maintains significant diversification through its propulsion segment comprising 41.5% of revenues that manufactures boat engines and related components. Brunswick also operates a parts and accessories business producing marine components.

This diversification provides revenue stability that pure boat manufacturers lack. However, it complicates direct comparisons and potentially dilutes management focus on specific product lines. Brunswick’s history includes numerous acquisitions and divestitures occasionally venturing outside marine industries.

Cash Flow Analysis

Cash flow generation varies significantly across the four companies due to differences in market share and product breadth. Marine Products and Mastercraft face disadvantages as smaller companies versus Malibu and Brunswick. All companies experienced negative cash flow during recent quarters except Brunswick benefiting from its propulsion business.

Mastercraft Boat Holdings appears strongest on cash flow metrics with attractive ratios relative to its size. The company generates more cash than Marine Products despite carrying higher debt levels. Analyst notes that Mastercraft’s debt-to-equity ratio remains fairly healthy at manageable levels.

Financial Strength Comparison

Marine Products posts return on equity of 36.07% with return on assets reaching 26.84% demonstrating efficient capital deployment. Mastercraft shows even stronger ROE at 41.13% though with higher debt utilization. Malibu Boats posts lower returns reflecting its debt reduction priorities over maximizing leverage.

Brunswick’s size provides advantages through economies of scale and market reach. However, its diversification may mask underperformance in specific segments. The company’s debt-to-equity ratio of 1.22 suggests aggressive leverage versus smaller competitors.

Investment Considerations

All four companies appear strong enough withstanding potential industry shakeouts during 2024 if economic conditions worsen. The two smaller companies, Marine Products and Mastercraft, appear stronger on value metrics versus larger competitors. Malibu Boats demonstrates strongest product positioning through its Cobalt brand reputation.

Marine Products shows best capital allocation discipline with zero debt and strong returns. Mastercraft generates superior cash flows relative to its size suggesting operational efficiency. Intense competition and uncertain economic conditions elevate risk levels making these stocks potentially better suited for watchlists than immediate purchases.

The Verdict

Financial analyst notes that Mastercraft Boat Holdings offers the best combination of product appeal, capital allocation, and cash flow generation among the four competitors. The company balances reasonable leverage with strong operational metrics.

Marine Products deserves credit for disciplined financial management though cash generation lags Mastercraft. Brunswick and Malibu serve as interesting comparisons but their size and strategies target different investor profiles seeking exposure to recreational marine markets.