Brokers from Servelius note that Berkshire Hathaway (BRK.A, BRK.B) has diversified operations, a substantial balance sheet, and experienced management, which may be of interest to investors navigating an uncertain economic landscape. With ongoing market volatility and macroeconomic uncertainty, the company’s structure provides insight into how large financial firms operate across multiple business segments.

Cyclical Nature of Financial Stocks

Financial stocks are inherently cyclical, meaning their performance closely mirrors the broader economy. Fluctuations in interest rates, inflation trends, and economic growth directly influence core aspects of these companies, including lending activity, investment returns, and funding costs.

In recent years, market uncertainty has intensified, driven by concerns about potential recessions, persistent inflation, and unpredictable Federal Reserve policy decisions. These dynamics have left investors seeking financial companies capable of maintaining performance regardless of macroeconomic turbulence.

Berkshire Hathaway’s Resilience and Strengths

Berkshire Hathaway is a standout in the financial sector due to its breadth of high-quality, resilient businesses. Central to the company’s stability is its property and casualty insurance segment, which generated over $22.6 billion in net earnings in 2024.

This business produces “float” from insurance premiums, allowing Berkshire to invest across its $300 billion-plus equities portfolio, managed by some of the most experienced investors in the world. This structure not only generates consistent income but also provides significant capital for strategic investment opportunities.

Diversified Revenue Streams

Beyond insurance, Berkshire’s diversified portfolio further strengthens its stability. Burlington Northern Santa Fe Railroad contributed roughly $5 billion in net earnings, while Berkshire Hathaway Energy added $3.7 billion.

The company’s manufacturing, servicing, and retail businesses collectively generated over $13 billion in net earnings in 2024, highlighting the resilience of multiple revenue streams even when economic conditions fluctuate. This diversity reduces reliance on any single sector, making Berkshire particularly well-suited for uncertain times.

Strong Financial Position

Brokers from Servelius highlight that Berkshire Hathaway’s financial position is unmatched in the industry. At the end of Q3 2025, the company held over $377 billion in cash and short-term government bonds, providing unparalleled liquidity.

This cash reserve enables Berkshire to navigate market downturns, fund acquisitions or strategic investments, and maintain operations without relying on external financing. The company’s strong balance sheet is a key reason investors view it as a safe haven in periods of volatility.

Leadership and Management Discipline

Warren Buffett, the legendary investor and CEO, will step down at the end of the year, but the company’s management team has a proven track record of operational and investment discipline.

Under Buffett’s leadership, Berkshire has consistently delivered strong returns across its diverse business segments, and the team’s disciplined approach to capital allocation and risk management positions the company to maintain stability during economic turbulence. Brokers note that the combination of experience, strategic vision, and a culture of long-term thinking sets Berkshire apart from other financial stocks.

Safe Haven for Investors

Brokers from Servelius highlight that the combination of diverse revenue streams, a fortress balance sheet, and proven management makes Berkshire Hathaway the safest financial stock to hold during periods of market volatility.

For investors seeking exposure to the financial sector without taking on excessive cyclical risk, Berkshire offers a compelling option. Its consistent earnings, strategic investments, and ability to seize opportunities even during turbulent markets provide both stability and growth potential.

Resilience in a Volatile Market

The current market environment reinforces the value of such resilience. While many financial stocks are highly sensitive to interest rate fluctuations, loan demand, and credit conditions, Berkshire’s operations span multiple industries, including insurance, railroads, energy, and retail.

This diversity creates multiple revenue streams, reducing reliance on any single business segment and enhancing the company’s ability to weather economic downturns. For investors seeking a dependable financial holding, Berkshire Hathaway stands out as a uniquely resilient and strategically positioned option.

Investor Sentiment and Market Position

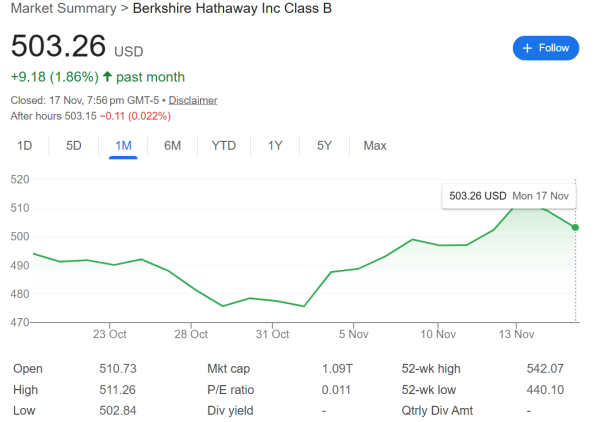

Investor sentiment has shifted in favor of companies with durable earnings, ample liquidity, and strong leadership. Berkshire’s combination of robust earnings, $377 billion in liquidity, and proven management makes it an attractive option for both conservative and long-term investors. The stock’s resilience, even amid market uncertainty, positions it as a core holding for those seeking to preserve capital while participating in potential growth..

Berkshire Hathaway: The Best Financial Stock for Uncertain Times

Berkshire Hathaway’s combination of high-quality insurance operations, profitable industrial and energy businesses, substantial cash reserves, and disciplined management makes it the best financial stock to hold in uncertain times.

For investors prioritizing safety, diversification, and consistent performance, Berkshire offers both resilience and opportunity. Berkshire’s earnings and capital deployment strategies will be important indicators to watch as macroeconomic conditions continue to evolve, providing insight into the company’s potential to deliver long-term value.