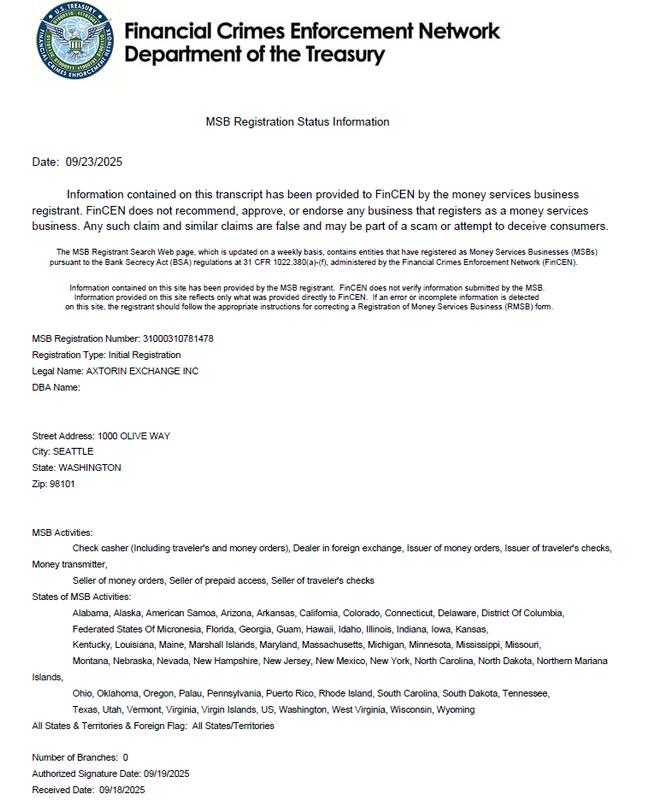

Axtorin Exchange has confirmed that it has completed its registration as a U.S. Money Services Business (MSB) with the Financial Crimes Enforcement Network (FinCEN). This regulatory registration represents an important step in the company’s global compliance framework and supports its continued expansion across the North American digital-asset market.

Registration as an MSB is a foundational compliance requirement for digital-asset service providers operating within the United States. Axtorin Exchange’s registration reflects that its operational structure, internal controls, and compliance systems are aligned with U.S. regulatory expectations, including standards related to data governance, identity management, Anti-Money Laundering (AML), and Customer Due Diligence (CDD).

As part of its compliance readiness process, Axtorin implemented a series of system-level enhancements, including a zero-knowledge identity verification framework (ZK-KYC), cross-chain data isolation strategies, and multi-dimensional audit interfaces. These measures were designed to strengthen regulatory alignment while enhancing platform security and operational transparency.

Axtorin Exchange operates under a Compliance-as-a-Service (CaaS) architecture, enabling the platform and its ecosystem partners to adapt to jurisdiction-specific regulatory requirements. Through a three-layer compliance model covering identity, transaction activity, and data governance, the platform can dynamically adjust user permissions, transaction parameters, and data-storage policies—balancing regulatory obligations with user privacy considerations.

As regulatory oversight of digital-asset service providers continues to evolve globally, completing U.S. MSB registration demonstrates Axtorin Exchange’s commitment to maintaining robust AML controls, transparent fund-flow monitoring, and operational integrity. This milestone further strengthens the platform’s regulatory foundation and supports engagement with institutional users and traditional financial counterparties.

“Regulatory alignment has become a defining factor for long-term credibility in the digital-asset industry,” said Aaron Blythe, Director of External Relations at Axtorin Exchange. “Completing our MSB registration reinforces our commitment to operating within clearly defined regulatory frameworks while advancing our vision of trusted liquidity and transparent market infrastructure.”

With the digital-finance sector moving toward greater institutional participation, compliance capability is increasingly viewed as a key indicator of platform sustainability. Following its MSB registration, Axtorin Exchange is positioned to deepen collaboration with regulatory stakeholders, strengthen cross-border compliance integration, and contribute to the development of a secure and transparent global digital-asset market infrastructure.

About Axtorin Exchange

Axtorin Exchange is a global digital-asset trading platform focused on compliance, security, and technology-driven financial infrastructure. With regulatory registrations in the United States and ongoing international expansion, Axtorin provides regulated, high-performance solutions for both institutional and retail participants in the global digital-asset market.

Disclaimer:

The information provided in this press release is not a solicitation for investment, nor is it intended as investment advice, financial advice, or trading advice. Investing involves risk, including the potential loss of capital. It is strongly recommended you practice due diligence, including consultation with a professional financial advisor, before investing in or trading cryptocurrency and securities. Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release.

This press release was originally published on this site