Ripple Labs, Inc. (Ripple), creators of the cryptocurrency XRP, are in the midst of an ongoing lawsuit involving the United States Securities and Exchange Commission (SEC). A December 2020 press release from the SEC states that the allegations against Ripple include raising funds using unregistered securities. Why did this lawsuit surface and what progress have we seen over the last 6 months?

What Is XRP?

Although the first use of cryptocurrency in the United States was in 1983, it was not until the introduction of Bitcoin in 2009 that it gained real buying power. Since then it has grown in popularity, partially because of the lack of government oversight. Now the government wants in on the action.

Ripple Labs, Inc. was the invention of Ryan Fugger in 2004. He envisioned a decentralized worldwide currency. Christian Larsen and Jed McCaleb founded OpenCoin in 2012 with the same idea in mind. The two companies merged in September 2013, creating the company in existence today.

According to the Motley Fool, XRP is a cryptocurrency specifically created for use by financial institutions and other payment services. It has a global payment software system that allows the cryptocurrency to be transferred with less fee– including costly exchange fees. The transactions are also much faster than the traditional methods for wiring and transferring money with transfers being completed in as little as 5 seconds.

Major banks and financial institutions have already signed up to use XRP, including names that are easily recognizable such as Bank of America, American Express, and until recently Moneygram.

Breaking Down The Ripple Lawsuit

In the allegations against Ripple, the SEC states that $1.3 billion have been traded by the company in unregistered securities. Ripple is answering the lawsuit by claiming that XRP is not a security.

Although XRP is one of the world’s largest cryptocurrencies, many cryptocurrency exchanges are no longer allowing investors to purchase it following the lawsuit. Unlike Coinbase and other prominent exchanges, some alternatives such as Uphold, Crypto.com, and KuCoin have been a go-to for people still interested in on-boarding XRPUSD.

Because cryptocurrency is still a maturing market, the Ripple lawsuit is treading on new ground. It will be up to the courts to decide whether or not XRP is subject to federal securities laws.

Two executives of the company are also facing charges. The allegations against former CEO Christian Larsen and current CEO Bradley Garlinghouse claim that the two raised money for the company by selling the digital assets worldwide, including the United States, where proper registration is required if cryptocurrency is found to be a security. They have offered no known exemption to these trading requirements, which include disclosures for buyers that include business practices and protections afforded to them in the public market.

The company also traded XRP in exchange for other non-cash business services. These services have been alleged to include labor and marketing services.

Larsen co-founded the company and was formerly Executive Chairman of the Board. It is also alleged that Larsen and Garlinghouse profited $600 million in personal sales of XRP.

This is not the first time Ripple has been in trouble with the law, in fact, the 2015 rebranding of Ripple Labs, Inc. to Ripple was brought about due to legal action. A press release dated May 5, 2015, from the United States Department of the Treasury Financial Crimes and Enforcement Network announced a $700,000 fine against the company.

This violated the Bank Secrecy Act. This act, also known as the Currency and Foreign Transactions Reporting Act was passed in 1970 to ensure that financial institutions assist the federal government in the discovery and prosecution of money laundering.

That was the first time legal action had been taken against a company dealing in cryptocurrency. At the time Ripple had agreed to change the way it did business. Protocols were set to change including increased monitoring.

Garlinghouse has been accused of making false claims about competitors, including inflating statistics. The CEO made claims that XRP’s major competition, SWIFT, had a 6% error rate, which was proven to be untrue. Garlinghouse also made inflated claims about the number of financial institutions that would be using Ripple’s tools. Garlinghouse would later make claims that he had “misread” news causing the dissemination of misinformation.

In October 2020 a member of Ripple’s board, Ken Kurson was accused of cyber-crimes by the United States Attorney for the Eastern District of New York. These crimes included stalking and harassment.

Effects Of The Lawsuit

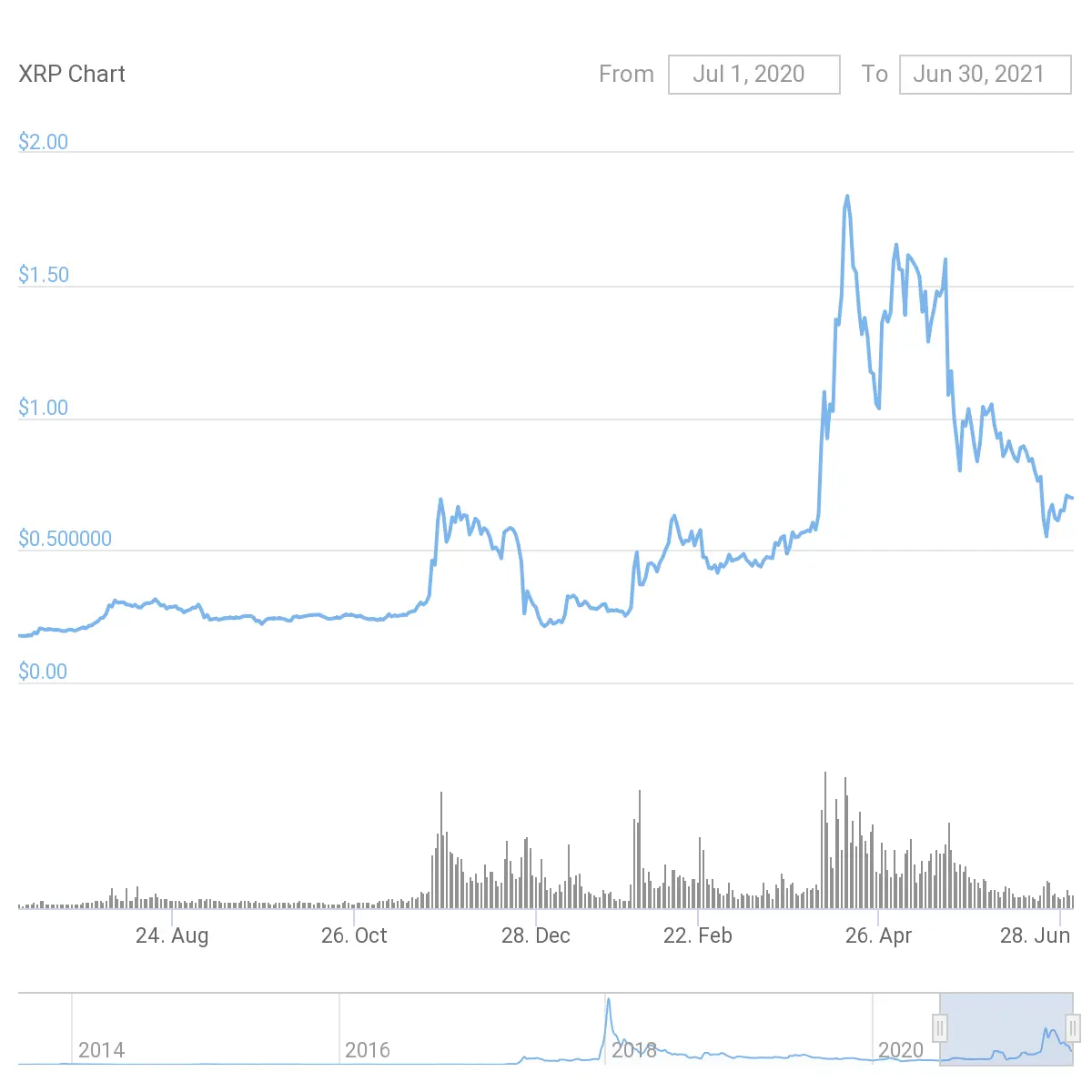

If Ripple wins the lawsuit, the cryptocurrency’s value is expected to skyrocket, which makes purchasing XRP a risky move that may have big payoffs. Unlike Bitcoin and Ethereum, which have recently cracked new all-time highs, XRP has not re-tested its all-time high in 3+ years. XRPUSD is still ~ 80% below its all-time high.

InvestorPlace.com reports that things in court are beginning to fall in favor of Ripple. A judge ruled on June 1, 2021, that the SEC does not have a legal right to Ripple’s interactions with their legal counsel, because it is protected under attorney-client privilege. However, that does not mean that the case will be settled anytime soon.

Ripple may be inclined to settle the lawsuit as soon as possible, even if it means paying out big fines to the government. Many investors are banking on a spike in prices if this happens.

The lawsuit also affects more than just Ripple. The world of cryptocurrency is often described as volatile, and the results of this lawsuit could sway investors one way or another. It will be important for investors to keep an eye on the Ripple lawsuit, which could have a lasting impact on the entire cryptocurrency market.

XRP Price

Most investors are confident that Ripple and XRP will bounce back, even if they have to payout. In fact, Ripple may be choosing to go public once the federal scrutiny and legal issues have been resolved. This is especially important given that the US Securities Regulator must approve that move. Discussions of going public pushed XRP up 14% despite its legal woes, according to Business Insider.

Despite volatility from legal concerns, XRP has still flourished over the last year. The 7th largest cryptocurrency by market cap has surged ~ 296%. This has outperformed Bitcoin when comparing 1-year metrics. It is important to note that this even occurred in an environment where large exchanges were delisting the digital asset this year. Investors hope for a scenario where Ripple prevails in the lawsuit and large exchanges start to relist the companies native token.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however, no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the cryptocurrency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal, or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal, and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.