Lukka, a leading crypto-asset software and data provider, announced it had completed its Series C funding round. State Street Corporation led the funding round with S&P Global and CAP.com, a subsidiary of AICPA, participating in the round as well. The investors in the Series C funding prove that crypto assets are growing in significance to traditional financial investors.

Plans For The Future

With the closing of Series C, Lukka will continue the expansion of its current institutional-grade software and data products. It will focus on getting traditional businesses and funds to adopt its products as they rapidly gain exposure to crypto-assets.

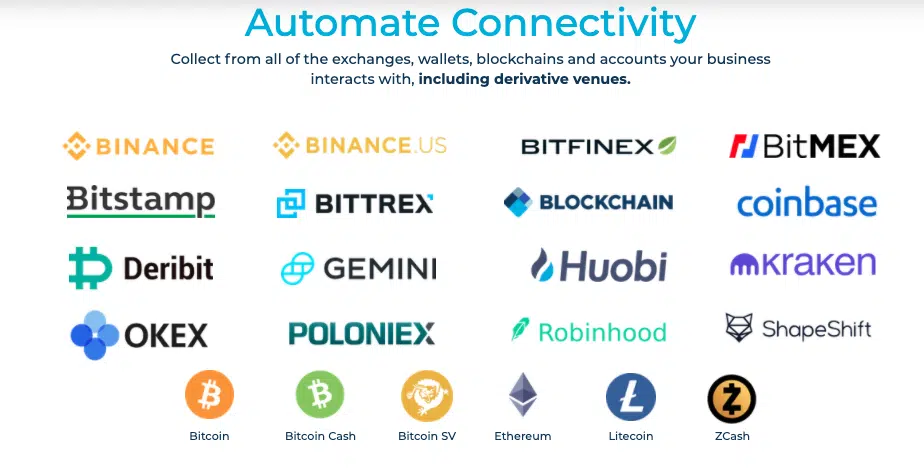

The software and data solutions developed by Lukka are designed to convert complex crypto asset and blockchain data into easy-to-use information that businesses can use in their traditional middle and back-office operations. To accomplish its goal, Lukka utilizes industry-leading technical control standards such as the AICPA SOC Controls.

Recent Accomplishments By Lukka

The announcement follows a recent revelation that Lukka is supporting S&P Dow Jones Indices in the launch of crypto assets indexing and benchmarking products. In 2020, Lukka has also collaborated with IHS Markit and dxFeed for the redistribution of their data products called Lukka Prime and Lukka Reference Data.

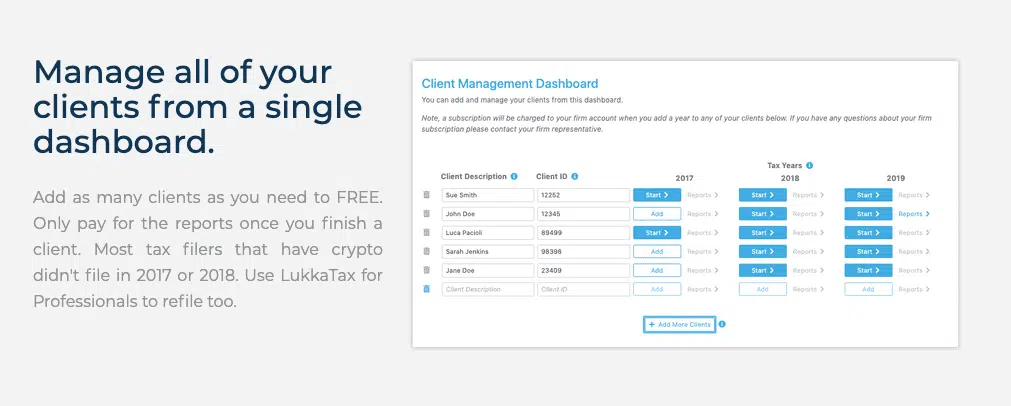

The two products are the world’s first fair market value pricing methodology for crypto assets. Lukka was made a preferred partner of CPA.com in 2019, which brought “LukkaTax for Professionals” to the market. The product is a software solution designed to assist tax professionals to serve clients who deal in crypto. Today, Lukka is recognized as the leading provider of institutional-grade software and data services for crypto assets.

What The Leaders Had To Say

Commenting on the successful Series C round, the Lukka CEO, Robert Materazzi said that they were excited to include three of their strategic partners in the funding round. He noted that the partnerships continued to highlight the growing importance of crypto assets to the traditional financial world.

The Lukka CEO added:

“Lukka has focused on building solutions with high standards that scale to the requirements of financial institutions and data providers. Our strategic partners, such as State Street, S&P Global, and CPA.com all play critical roles in the financial ecosystem that Lukka is proud to support.”

Jen Tribush, Global Head of Alternatives Product for State Street said that State Street was pleased to collaborate with Lukka as they progressed on their broader digital asset strategy. According to Tribush, State Street was continually looking for opportunities to evolve their business and develop solutions for their clients’ needs. Tribush added:

“Lukka brings an institutional mindset to their technology solutions that can serve as a conduit for crypto and traditional assets.”

Dean Sakati, the Global Head of Product Innovation and Business Development for State Street, also commented on the funding round. He noted that their partnership with Lukka underscored their broader commitment to innovation as their institutional clients continue to adopt crypto assets.

2020 has seen increased institutional interest in crypto assets. The recent success of Lukka’s Series C funding round is proof of that. For instance, State Street, which led the funding round, has $36.6 trillion in assets under custody and/or administration and $3.1 trillion in AUM as of September 30, 2020. When such a major company takes interest in crypto, it will no doubt encourage others in the mainstream financial world to take an interest in this emerging market as well.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.