Over the last week, most of the top large-cap cryptocurrencies have seen small losses. With Bitcoin price failing to create any positive momentum, it has altcoins like Ethereum and XRP following similar sentiment. As October begins, Bitcoin will try to decouple from traditional markets, in which it has been highly correlated to. With various cryptocurrencies ready for a breakout, what levels will be on watch for Bitcoin, Ethereum, and XRP in the short term?

Bitcoin Price Momentum & Altcoins

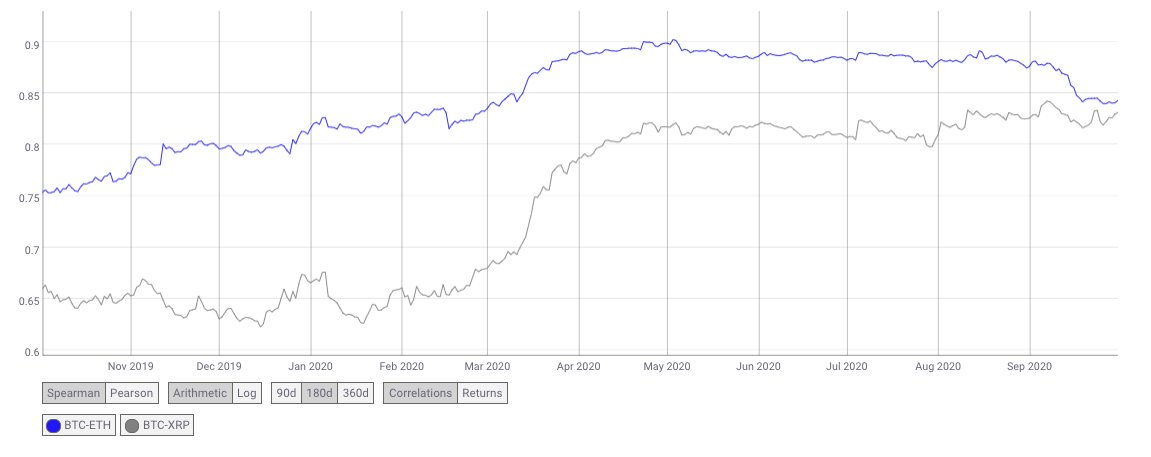

For a while now, it is no surprise that altcoins are highly correlated to Bitcoin price. Coming into 2020, many investors thought this would change, but it has actually gotten worse. For example, DeFi markets were expected to help Ethereum decouple from Bitcoin, but that has not been the case.

The chart above shows Ethereum and XRP correlation to Bitcoin over the last year. A 1.0 correlation would mean 100% correlation to Bitcoin. As we can see, both ETH and XRP are in the .80 range which is a high correlation. Correlations have become tighter since late 2019.

Bitcoin Technical Analysis

In recent Bitcoin technical analysis, it was outlined that Bitcoins price was flirting with important support at $10,600. Over the last couple weeks, BTC has consolidated in this range. There was a decent sell-off last week following BitMEX criminal charges, but Bitcoins price quickly recovered near that $10,600 channel.

Bitcoins price has continued to trade in this $10,600 channel, and many believe it is ready for a breakout due to the extended consolidation. At the time of this reporting, Bitcoin price is $10,567. In order to get bulls back in control, we firmly believe that BTC needs to close above and hold $10,600 levels.

If we continue to see this weak price action below $10,600 support, it could fuel bears in the short-term to push prices to $9,200 support levels. In terms of momentum, ROC ( bottom of the chart ) is now threatening to drop below 0 which would represent weak price action and bearish momentum. Until BTC can regain and hold $10,600 levels, we will remain neutral.

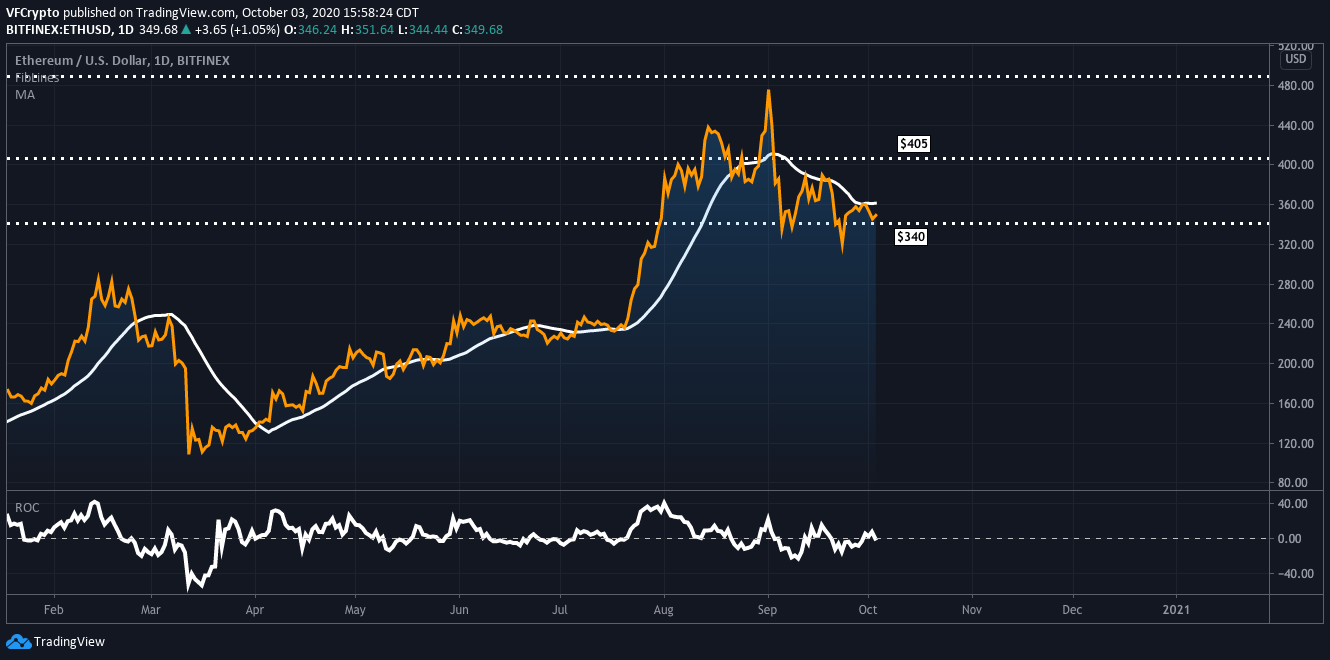

Ethereum Technical Analysis

At the time of this report, Ethereum is trading at $349.68. As we can see from the chart below, ETH recently bounced off strong support at $340, attempting to build bullish momentum.

Right now, $340 will be the level to keep an eye on. As long as ETH can hold this support level, it could very well be eyeing resistance at $405. To verify this upward momentum, we are also watching to see if ETH can trade above the 25 day moving average. Despite building some upward momentum, ETH still resides below the 25 day MA. Once this is confirmed, it is believed that many traders will be watching for a rally to $405 resistance. Despite this, we still remain bullish based on current technicals.

XRP Technical Analysis

Similar to Bitcoin, XRP price has been weak over the last couple weeks as well. XRP has failed to close above $0.24 levels which may be bearish in the short term.

XRP is having issues breaking through the $0.24 wall. In the short-term, traders will be watching to see if XRP rejects $0.22. In doing so, it could propel a heavy sell-off. On the flip side, if XRP can close back above $0.24, many would argue that bullish momentum would be initiated, with the ultimate goal of testing resistance at $0.284. If we look at the chart above, $0.24 has historically been an important level for XRP over the last year. Next week should be an interesting week to further identify which direction XRP is trending. We remain neutral on XRP going into next week.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.