We take a look at Ethereum prices for the week of September 13, 2021. Aside from fundamentals, we rely heavily on technical analysis to assess overall sentiment. This is achieved by identifying key support and resistance levels that traders and investors will be watching in the short term. Based on the current price action, what does the sentiment look like this week for ETH?

Ethereum Price

At the time of this report, Ethereum is currently trading at $3,291. The second-largest cryptocurrency by market cap has only seen ~ 1.3% growth over the last month.

Despite the small gains, Ethereum has managed to outperform most large-cap cryptocurrencies. Bitcoin has fallen ~ 5.38% and XRP has dropped ~ 5.95%.

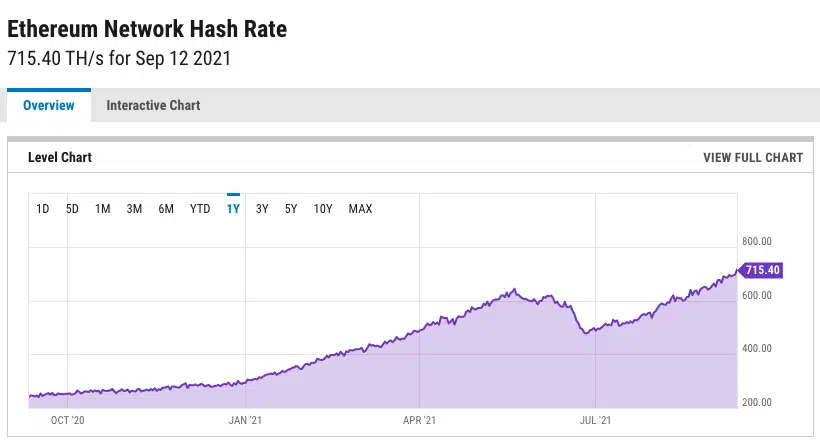

On the fundamental side, the Ethereum hash rate continues to make new all-time highs. Increasing NFT activities are driving up demand on the Ethereum network. This is being facilitated by NFT minting that pushes up miner revenues.

Ethereum Technical Analysis

At the time of this analysis, we are targeting $3,200 as a key support level. It will be important to watch this level in the short term to assess Ethereum sentiment.

As long as Ethereum holds $3,200 support, we expect to see bullish momentum. The next leg up could send Ethereum to resistance at $3,700.

On the contrary, Ethereum could see a sharp sell-off if $3,200 support is rejected. In this environment, we expect ETH to test $2,840 support.

Fairly Bullish

As of now, the sentiment seems to be fairly bullish. We have outlined ROC ( rate of change ) at the bottom of the chart, which denotes sentiment. Historically, ROC greater than 0.00 is a bullish indicator. Traders will argue that bullish momentum is starting to heat up as ROC gets closer to 0.00. If we look at historical price action, many rallies were triggered when ETH ROC was right around the current levels.

Unlike most altcoins, we expect that Ethereums correlation to Bitcoin will continue to dwindle. Ethereums infrastructure is driving NFT markets and its growing utility should drive prices moving forward.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however, no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the cryptocurrency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal, or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal, and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.