Blockchange, the asset management platform for RIAs, announced the addition of fourteen new digital assets to its BITRIA Digital Turnkey Asset Management Platform. In an environment where wealth managers have interest in diversifying their clients in non-correlated assets, Blockchange is bringing modern portfolio theory based tools to DeFi and other digital assets.

Blockchange Platform

The Blockchange “BITRIA™” platform is introducing registered investment advisors ( RIAs ) and wealth managers to professional grade portfolio management tools. Through the interface, advisors have a dedicated spot to manage client assets. With financial advisors primarily focusing on diversification, Blockchange offers custom portfolio allocations and rebalancing of digital assets. The platform is also non-custodial, meaning financial firms can choose which custodian they would like to leverage.

DeFi and Other Assets

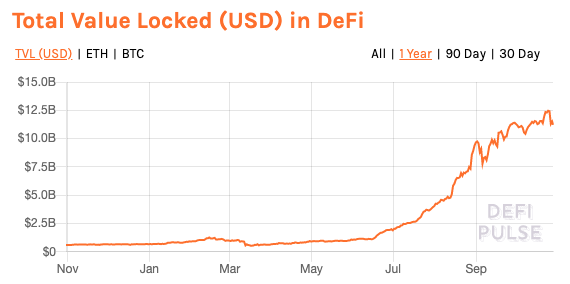

In a recent announcement from the firm, Blockchange has added support for 14 new assets to their BITRIA™ Digital Turnkey Asset Management Platform. Of the 14 new additions, 10 of the digital assets are DeFi based. Decentralized finance protocols have taken off in 2020, with more than $11 billion dollars being locked in DeFi based protocols to date.

From an investing standpoint, many millennials have expressed interest in DeFi projects due to the potential upside. With a longer time horizon, millennials tend to be less risk-averse compared to other folks. According to Blockchange, wealth managers see this as an opportunity to further diversify their client base and grow assets under management.

Dan Eyre, the CEO of Blockchange commented that:

“DeFi assets add yet another layer of diversification for investors as they’re not correlated with traditional assets or even with more firmly established cryptocurrencies. The risk-reward profile of DeFi also offers tremendous growth potential for investors – somewhat like the early days of Bitcoin and Ethereum. The BITRIA platform allows advisors to offer these opportunities to their clients while benefiting from the experience of other firms with more experience in the asset class.”

Blockchange stated they would now offer support for the following assets:

- Balancer ( BAL )

- Compound ( COMP )

- Curve ( CRV )

- Decentraland ( MANA )

- Kyber Network ( KNC )

- Maker ( MKR )

- Orchid ( OXT )

- Ox ( ZRX )

- Pax Gold ( PAXG )

- Ren ( REN )

- Storj ( STORJ )

- Synthetix ( SNX )

- Uma ( UMA )

- Uniswap ( UNI )

It is important to note that prior to these additions, the BITRIA platform already supported:

- Bitcoin ( BTC )

- Ethereum ( ETH )

- Litecoin ( LTC )

- Bitcoin Cash ( BCH )

- Zcash ( ZEC )

- Basic Attention Token ( BAT )

- Chainlink ( LINK )

Blockchange told Visionary Financial that after launching the platform in July and partnering with Gemini exchange In August, several RIAs are now using it to oversee client assets. Head of Marketing, Daniel Tardent also told VF that their platform continues to grow quickly, especially with Bitcoin’s growth this year. At the time of this reporting, BTC has surged +81% YTD.

With RIAs historically ignoring cryptocurrencies from a compliance standpoint, Blockchange said a massive shift is occurring, as advisors are understanding the asset class and adjusting accordingly. Daniel Tardent commented that:

“Firms are realizing that they have a fiduciary responsibility to understand the asset class and develop a plan for how they intend to provide suitable clients with exposure. They still need to check all of the boxes from a compliance perspective and ensure that they are reporting everything correctly, but direct investment in digital commodities is doable and of great interest to many RIAs today.”

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.