We take a look at Bitcoin price, Ethereum price, and XRP price for the week of February 5, 2021. Aside from fundamentals, we rely heavily on technical analysis to assess overall sentiment. This is achieved by identifying key support and resistance levels that traders and investors will be watching in the short term.

Bitcoin Price

At the time of this report, Bitcoin is currently trading at $40,169. The largest digital asset by market cap has continued to experience upward momentum. Over the last week, BTC has rallied ~ 18.3%. Additionally, BTC has seen ~ 22.6% growth over the last two weeks. Bitcoin is rebounding quite well from its sharp sell-off to start the year. Recent rallies now put BTC in a prime position to retest all-time highs of $41,940, which were accomplished about 29 days ago. As mentioned above, Bitcoin’s recent rally comes after a sharp sell-off in January. After cracking new all-time highs, BTC had lost ~ 31% of its value and bottomed around $28,845 on January 22nd.

Bitcoin Technical Analysis

In our previous Bitcoin analysis, it was believed that BTC would continue to see upward momentum as long as $29,300 support was maintained. During the most recent price action, Bitcoin has used this support level as a launchpad. As expected, bullish momentum has continued to mount.

After following last week’s price action, it appears that BTC wants to retest all-time highs that it achieved 29 days ago. It will be important to watch $41,900 resistance levels in the short-term. If BTC can accept these levels, we could see another sharp move up. BTC formation right now is almost like a “reverse head and shoulders,” which is historically bullish. The quick recovery over the last month goes to show investor sentiment right now.

If Bitcoin can’t accept $41,900 resistance, the digital asset could witness strong selling pressures. A restest of $35,000 support could come to fruition in this environment. Expect volatility to ramp up here as Bitcoin decides whether or not it’s time to put in new all-time highs.

Ethereum Price

At the time of this report, Ethereum is currently trading at $1,713. Among large-cap altcoins, ETH has been one of the top performers. Over the last week, ETH has rallied ~ 23%. Over the last month, ETH has surged ~ 41%. More importantly, Ethereum put in a new all-time high last week of $1,752 ( Feb 5th ).

Ethereum Technical Analysis

If you have been following our recent reports, Visionary Financial stated that Ethereum was our highest conviction pick going into the new year. Based on historic price action, it was evident that ETH would outperform in the short term and create new all-time highs.

In recent Ethereum analysis, it was believed that the second largest digital asset by market cap would continue its upward trend as long as $1,187 support was not rejected. ETH did just that and continued its push to new all-time highs.

With the recent moves, we have now set key support at $1,475. As long as Ethereum does not reject this level, we believe the sentiment will continue to be bullish. This could push ETH to $1,800 territories in the short term. On the contrary, if ETH rejects $1,475 support, it could result in a relatively strong sell-off in the short term. As of now, we still support our theory from previous reports that ETH will continue to outperform Bitcoin.

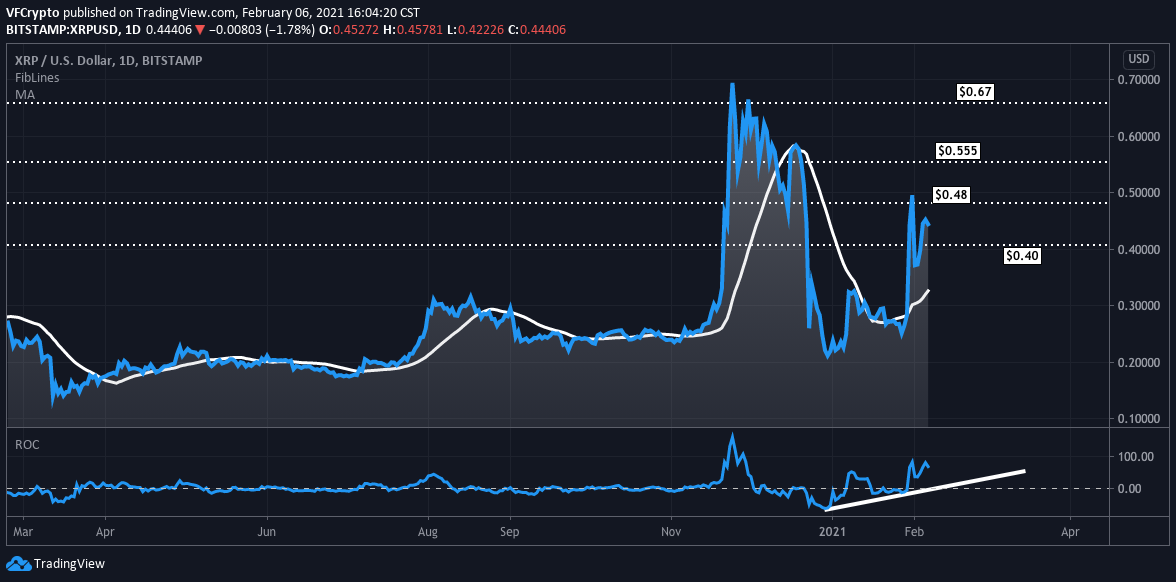

XRP Price

At the time of this report, XRP is currently trading at $0.446. XRP far outperformed ETH and BTC over the last week, posting ~ 58.5% gains. XRP has also seen a ~ 77% surge over the last month. XRP saw its value crash in December following the Ripple / SEC lawsuit initiation, but investors have seemed to brush off these allegations, especially since most of XRPs activity is occurring outside of the United States. A perfect example of this is Japan’s SBI adding XRP to a new cryptocurrency lending service two days ago. The lending service is offered on SBI VC trade, which is a popular crypto exchange outside of the U.S.

XRP Technical Analysis

In recent XRP analysis, it was believed that XRP would continue to trend higher if $0.20 support could be maintained. As expected, XRP maintained this support and saw parabolic price action last week.

Based on last week’s behavior, we have now adjusted key support levels. As long as XRP can hover above $0.40 support, we believe bulls will maintain control. XRP is attempting to bust through $0.48 resistance right now. If this happens, watch for XRP to target $0.50-0.60 levels in the short-term. On the flip side, if XRP ends up rejecting $0.40 support, we expect a relatively strong sell-off.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.